Originally published on Phocuswire

Group travel has been one of the hardest hit areas of hospitality as a result of the pandemic. Large events have been continuously cancelled or rescheduled, family and friend rendezvous have been postponed, and hoteliers have had to navigate a very different environment with fewer staff and less predictability than ever before.

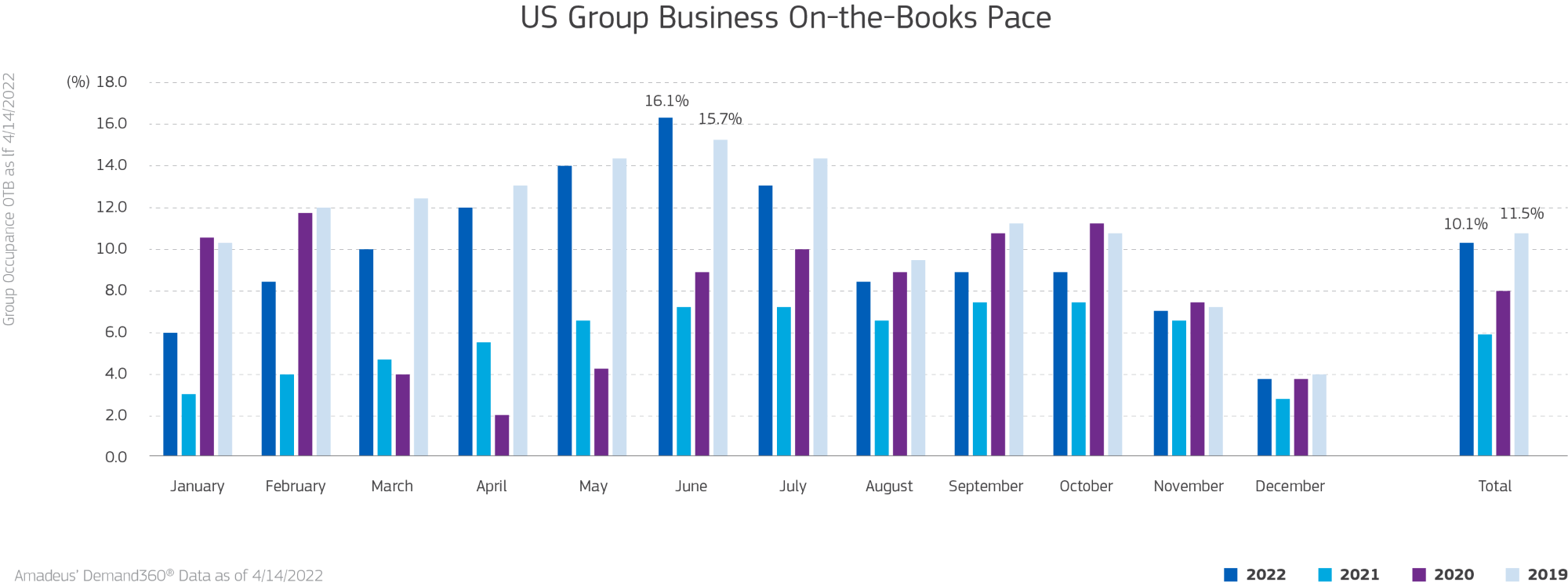

But Amadeus business intelligence data shows group travel is on the rise once again – and could be on track for a record year. As of April 14, 2022, and for the first time since the pandemic began, Group (block + sold) for June 2022 exceeds the performance of June 2019, and Group pace is only trailing 2019 by 1.4% for the full year.

With 7 months to go in the year, there is still significant potential for the industry to surpass to pre-pandemic levels. However, this will require adjustments from hoteliers to capitalize on growing demand since today’s meetings and events look and feel different from pre-pandemic norms.

In order to help hoteliers plan for this new era, Amadeus combined insight from industry experts with business intelligence data to identify the key forces shaping group business. The research revealed five major trends that will guide the group travel and events market in the year ahead.

1. Changing group travel behavior

According to Amadeus’ Demand360® data, hotels in unexpected destinations are seeing increases in group travel bookings this year. While some US cities like Orlando, FL and New Orleans, LA remain popular, non-traditional locations like Anchorage, AK and Tuscaloosa, AL are unusually in the top 20 markets for 2022. Compare this against a dynamic city like San Francisco, CA, which is experiencing lower occupancy when compared to pre-pandemic activity.

The groups traveling are not only trying new markets but doing so with less people. In 2022, Amadeus MeetingBroker data shows 63% of event RFPs (request for proposal) have been for groups of 50 people or less compared to 58% in 2019. In addition, the average lead-in time for an RFP has shortened from 223 days in 2019 to 193 days in 2021.

2. Lean teams have to do more with less

Staff shortages are nothing new in hospitality but when it comes to sales and operations, things have gotten tough. Sales teams are having to restructure to handle a higher volume of smaller deals, with less commission and reduced staff. Reward structures need to be re-evaluated across the board to ensure they match the type of sales on offer and the requirements of the sales teams as they stand today, not pre-pandemic.

Operations teams are also feeling the pinch when it comes to the on-property experience of groups. With less headcount, there is a limit to how many groups a property can serve with the operational staff available. Adopting technology to manage disruptions related to COVID-19 while streamlining and automating daily tasks can put hotels in a much better position to react to the current environment.

3. Hybrid and in-person meetings are here to stay

Hybrid meetings and events are now an established part of business travel thanks to significant technology advancements supporting remote work. But this trend has added to the workload for hotels at a time when human resources are scarce, so managers need to ensure they have the ability and know how to deliver on the technical elements of the event. Hiring a third-party vendor to lift the technical and administrative burden from in-house staff may be worthwhile, since service expectations from guests remain high.

Hybrid events are a major contributor to the trend towards smaller group size, but they reinforce the need for hotels to deliver an outstanding on-property meeting and event experience. It’s important that attendees and businesses alike feel the benefit of traveling to an event and meeting in person, because today there are viable options for staying home. The on-property experience is a vital part of the hybrid package and feedback from attendees will be business critical for hotels looking at return bookings and positive sentiment.

4. Meeting planner relationships will be (even more) key

Amadeus data shows that RFPs from meeting planners increased by 51% in 2021 compared to 2020 which is fantastic news for the industry. As group travel returns, competition will too, making speed of response to RFPs more important – the old adage of the faster the response, the more likely the deal still rings true. Hoteliers need integrated solutions to help them answer quickly, accurately, and profitably.

However, technology is only one piece of the puzzle. As negotiations remain competitive, nurturing planner relationships will be key in this climate. Meeting planners are finding themselves in a strong position when it comes to the terms and conditions they can request of their hotel prospects, and greatly appreciate a degree of flexibility in terms of food and beverage commitments and/or project timelines. This is another area where real-time market data can help hoteliers make the right decision on whether to respond to the RFP and what lengths are sensible to go to.

5. Innovative partnerships are unlocking new potential

New alliances between hotels and businesses are helping to broaden reach and secure bookings as global organizations continue to innovate the way they work, including when and where they hold meetings. This new paradigm has created demand for function space and meeting rooms for employees to meet, either informally for social-led interactions or more formally for business meetings. Some major hotel chains have created enticing packages for business travelers who need a space to work during the day, plus a venue for evening entertainment with clients and colleagues.

Another way for hoteliers to grow new revenue streams is to negotiate interesting partnerships with similar properties in the same market or neighboring regions, giving guests access to amenities or function space in both properties with potential upsell opportunities.

For large multi-brand groups or hotel management companies, a CRM solution is a must to share leads across brands and global regions. This helps to keep all bookings within the portfolio – if the Crowne Plaza Midtown is booked, perhaps there’s room at the Crowne Plaza in Times Square. Watching the market and thinking differently is the name of the game to unlock new potential.

While the picture for 2022 continues to evolve, Amadeus data is showing considerable cause for optimism for the return of group travel in the US. But it would be a mistake to approach the rebound as ‘business as usual’. Behavioral changes around group travel as well as the inescapable labor shortages hoteliers are grappling with mean that a fresh perspective has to be taken on how to plan for, pitch, execute, and ultimately reward group travel in 2022 and beyond.

For more considerations around planning for the return of group travel, visit our website.