UK and Ireland Forward-Looking Data Insights

December 2020

It’s Christmas, but not as we know it. What impact does this have on hotel and flight bookings for December and January?

The festive season is normally the most wonderful time of year. But with ongoing challenges in Hospitality and beyond across the UK & Ireland, it can be challenging to get into the spirit this year. However, with news of vaccine approvals and reduced quarantines, there are signs of positivity. As we close out 2020, we take a look at the latest forward-looking hotel and flight data to understand demand over the Christmas period, and the start of the New Year.

Who and where are people travelling throughout December and January?

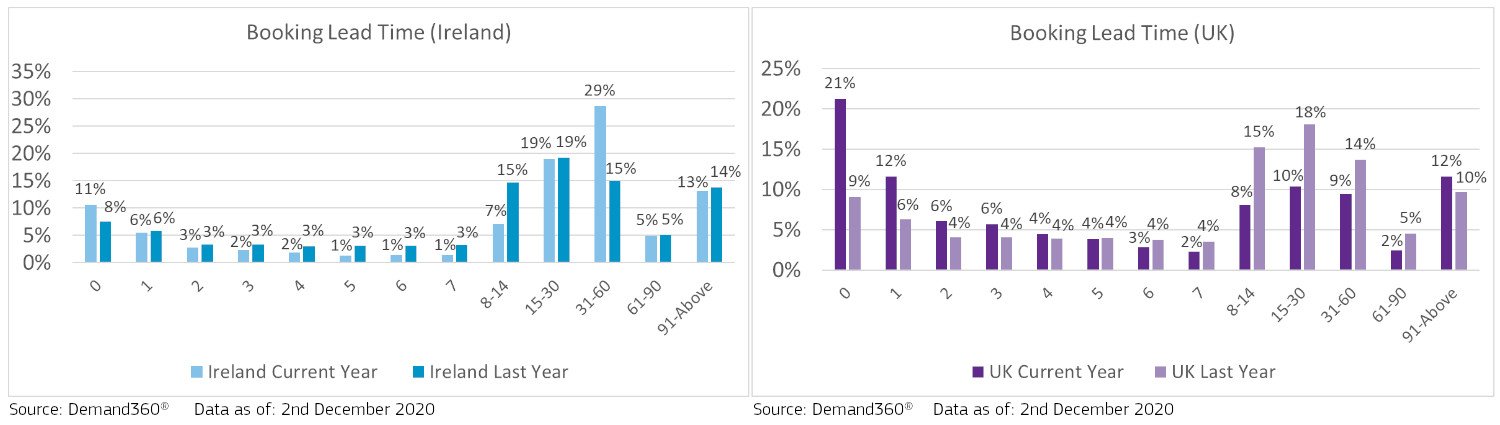

With tiered restrictions and lockdowns still in place across the UK & Ireland, bookings remain low across most places. However, for those with properties in the UK, remember that lead times are still reduced, with 58% of bookings currently made within 0-7 days, of which 21% are same day bookings. In Ireland, since November, lead times have started to more closely mirror those of 2019, and just under a third are made in the less than one-week window.

With reduced demand, and much of it coming in last minute, we provide some key recommendations to think about across December and January.

Firstly, keep an eye on your competition. 87% of hotels are open in the UK, and 92% are open in Ireland. Recent booking trends have shown mid-upper hotels to perform slightly better than other hotel types. However, looking at Christmas, luxury hotels are slightly ahead, indicating that price may not be a key driver, but rather the opportunity to treat ourselves or our loved ones. For Ireland, Average Daily Rates are also on the up for December and January, even compared with 2019. This means that despite lower occupancy, hotels may see some positive impact on revenues.

When thinking about promotions for the rest of 2020 and early 2021, keep traveller motivations top of mind. In the latest Visit Britain Consumer Sentiment survey, 62% cite Government restrictions as reasons for not travelling. But for those who will, hotels/motels/inns are their preferred choice of accommodation. This indicates that a focus on flexibility may spur greater demand than competing on price alone.

Our data shows that for Christmas and beyond, the areas expected to have the highest occupancy are Manaton, with upwards of 30% for Christmas and above 70% in January, Galway with around 35% in December and January, followed by Carlisle and Dublin with around 20% and 15% respectively.

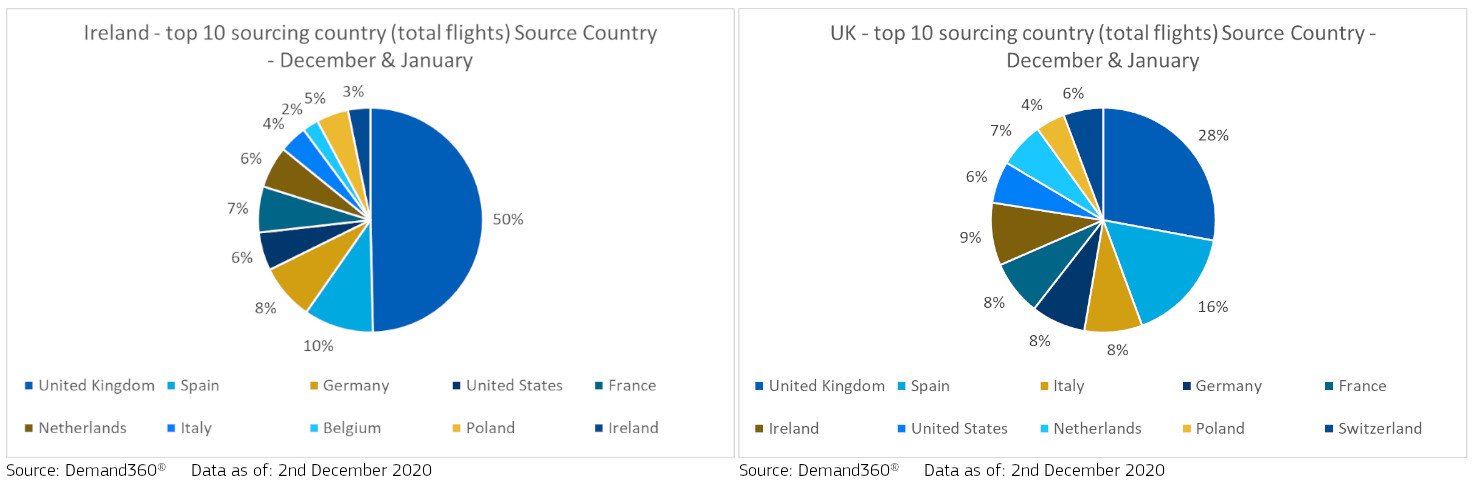

With the reduction in quarantine times across the UK & Ireland, this might bring in potential demand from neighbouring countries, as many return home for the holidays. For the UK, domestic travel still tops the list, with almost 30% of flights coming from within. Ireland too expects half of their flights to come from the UK. Otherwise, when thinking about attracting available demand, target promotions across Europe, with almost all remaining flights coming from this area.

What about the rest of the world?

With almost everyone facing second and third waves, the global occupancy average as of early December is 28%, with South Pacific seeing highest occupancy overall. This trend continues as we look at bookings for January and February 2021. Across Europe, the UK and Ireland has higher expected occupancy than other key markets, such as France, Spain and Germany for the Christmas period – likely due to similar ongoing lockdowns in these areas. In terms of booking channel, the same trends in the UK & Ireland are present worldwide with OTAs, Brand.com and Direct making up the greatest proportion. With early 2021 seen as a critical period for vaccine approvals and the introduction of rapid testing at airports, it’s important to keep an eye on how booking behaviour progresses in line with growing demand for travel.

Using on-the-books data is a valuable asset during this time to ensure that hoteliers are making informed decisions. If you’d like a complimentary Amadeus Business Intelligence report, including forward-looking hotel and flight data, or just want to understand more how this data can benefit you, reach out to one of our experts.

2020 UK Forward-Looking Data Insights

Want to find out more about this data?

Our Business Intelligence Solutions help hoteliers understand their market and competition, so they can make better and more informed decisions about their business.

Discover more of our dedicated UK and Ireland resources