Gain market insights

Hospitality and Hotel Market Reports, Insights and Trends

Whether you are a hotelier, DMO, CVB or other, this comprehensive hospitality market report hub is designed to help build strong, data-driven revenue strategies to attract guests or visitors with the world’s most comprehensive travel data and media services.

Since historical data is less relevant as the market has evolved post-pandemic, guidance from the industry’s most comprehensive forward-looking business intelligence suite is more useful than ever before.

On this page, you’ll find reports powered by Amadeus Business Intelligence data, offering insight into global market performance and booking trends to help inform your business and pricing decisions to remain competitive.

Hospitality market insights

At Amadeus, we are closely monitoring travel recovery and are committed to helping hoteliers and travel players build strong, data-driven revenue strategies. With our Market Insights Portal, you can access multiple reports and content powered by forward-looking data to help inform your business and pricing decisions as travel recovers.

With combined hospitality market data across our business intelligence solutions, we provide weekly and monthly reports and rankings of the top global markets by region.

Finally, don't forget to follow us on LinkedIn to get notified of the weekly updates.

Hospitality market insights

Hospitality Market Data – April 2024

Get brand-new industry insight to inform your hotel’s revenue strategy. Using Amadeus’ Demand360+® forward-looking occupancy data, this month’s report includes an overview of global booking trends along with occupancy, booking lead times, channels, pace, and segment mix across all regions worldwide.

Hospitality market insights

Complimentary Property-Level Data

Request your free property-level demand and agency data "Snapshot" reports (powered by Amadeus Demand360+ and Agency360+ business intelligence solutions) to better understand how your property stacks up against the competition on ADR, rates, occupancy, and agency booking dynamics.

Hospitality market insights

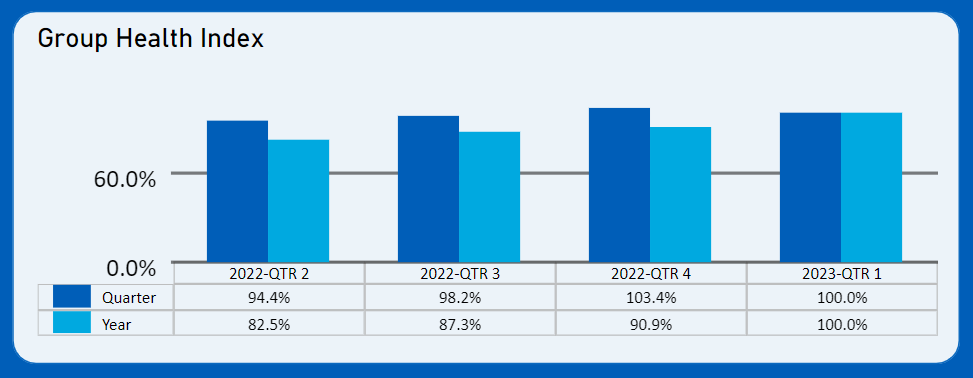

Hospitality Group & Business Performance Index

Gain a comprehensive overview of key drivers of US hotel performance, including group, corporate, and GDS bookings, as well as meeting and event insights. The Hospitality Group & Business Performance Index offers a detailed view of US industry activity, comparing quarterly figures to 2019 performance.

Access our Hospitality Group & Business Performance Index here.

Hospitality market insights

Top 10 Global Hotel Markets

Find out which markets are capturing the most demand with our weekly rankings of the top global markets by region.

Our Amadeus Hospitality Market Health Index with top performing markets: Global, Asia, Canada, Caribbean, Europe, Greater China, Latin America, Middle East/Africa, South Pacific, United States.

Access our Hospitality Market Health Index for each of these regions by clicking on the video to the left or by clicking here.

Hospitality market insights

Weekly Market Insights Report

Find out which markets are capturing the most demand with our weekly rankings of the top global markets by region.

Our Amadeus Hospitality Market Health Index with top performing markets: Global, Asia, Canada, Caribbean, Europe, Greater China, Latin America, Middle East/Africa, South Pacific, United States.

We are also closely tracking 50 markets with on-the-books reservation data extracted directly from hotels partners.

Access our Weekly Market Insight Report here.

Hospitality market insights

Top 10 Alternative Accommodations Markets

Alternative accommodations continue to profit from their “home away from home” feel, with the numbers to prove it.

In this context, it is interesting to gain deeper insight into this rapidly expanding world of short-term rentals.

In this report, you will be able to view the top short-term rental markets by region and compare trends week over week to understand how short-term rentals may be impacting your market.

Here you can access the Top 10 Alternative Accommodations Markets report.

Hospitality market trends and changing dynamics

Hospitality market trends and changing dynamics

The uncertain environment due to the pandemic has raised a lot of questions across the industry, including how to adapt hotel strategies and pricing to continue to attract guests to their hotel or destination.

How can hoteliers or destinations gain clearer visibility on their markets? How can they identify the right pricing in these shifting conditions? And how will Covid continue to evolve guest purchasing behaviors?

In the next sections, we will cover how booking patterns have changed, traveler behaviors have evolved towards evermore flexibility and market conditions remain fickle.

Hospitality market trends and changing dynamics

How has Covid changed Hospitality strategy and planning?

Historically, hoteliers or destinations relied on data about their past to help them plan for their future. They would plan their communication and pricing strategies ahead based on previous years´ booking and occupancy data and would make estimates, plan their strategies and make pricing decisions based on that past data.

Yet, COVID-19’s impact on travel has completely shaken this approach and changed booking and occupancy patterns forever. It has fomented a feeling of uncharted territory for many hoteliers or destinations. Historical data is all but irrelevant right now, and hospitality players need to adapt to this new paradigm by building their revenue strategies in alignment with current market trends.

This makes it more critical than ever to have access to powerful business intelligence tools that provide access to comprehensive, real-time, forward-looking and on-the-books hospitality market data.

Hospitality market trends and changing dynamics

Fast changing demand

It may have been a normal process for destinations and hotels to map out business strategies long in advance or on an annual basis, but the pandemic has forever changed travel dynamics. Today, they must regularly and frequently evaluate market indicators to understand when and how to plan their communication and pricing strategies.

The new situation has caused significant changes to booking habits and behaviors of travelers. They are now more digital, home-based, selective and conscientious in their spending. They feel more vulnerable, are more concerned about their health, and require evermore flexibility. In this sense, business models for hospitality businesses will need to adapt and respond to this behavior shift, partly with the support of technology.

Hotels and destinations should be prepared to pivot their plans and strategies and adapt based on their current market conditions. In this context, it is recommended you monitor what market data is telling you by having a look into market trends in your location and from there, analyze how to capture rising revenue opportunity. For instance, you can access our local hospitality market report to find out occupancy data in your location. This data can then inform your future strategies to produce more profitable bookings.

Because your market conditions have likely shifted since 2019, it is recommended to keep a constant pulse on any changes in your local or regional markets that could trigger a rise or fall in demand. Be prepared to change your rates at a moment’s notice.

Hospitality market trends and changing dynamics

Compressed booking window

The compression of the reservation booking window during the pandemic was unprecedented. At the height of the outbreak in 2020, the average lead time for hotel bookings shrank to just 0-7 days, according to Amadeus Demand360 data.

This behavior has persisted throughout Covid, as most guests are booking last-minute and engaging more with last-minute offers.

Now as we shift to pre-pandemic norms, it will require hoteliers to closely monitor their local market conditions and have a wide range of strategies ready to deploy.

To find out more, listen to our podcast: The Compressed Reservation Booking Window and What it Means for Your Hotel with Katie Moro and John Hach in which we explore the unprecedented compression of the reservation booking window and what it means for hoteliers around the world.

Hospitality market trends and changing dynamics

Shifting distribution mix

Covid has changed the way people are shopping for hotels, and comparing trends against historical data makes it nearly impossible to recognize success in today’s market. This means that what may have constituted as a “high performance” channel in the past may have changed. It’s important to ensure your distribution strategy is still producing results – and that you are maximizing your visibility on today's high-performing channels.

To capture the most opportunity moving forward, hoteliers and destinations will have to test new channels that may work better for them today. This allows opportunities to drive more bookings and optimize your property’s ability to capture recovering demand.

Pairing proactive email marketing campaigns with tailored advertising and promotions on paid search, display, social, SEO, metasearch, and GDS will keep your hotel or destination highly visible on the channels where travelers and travel sellers are looking and booking.

Finally, while OTAs have been and will continue to be crucial business partners for properties of all shapes and sizes, they are often a less profitable booking channel. And while the channel mix continues to evolve and will most likely revert back towards pre-pandemic levels as demand continues to emerge globally, hoteliers and destinations now have the opportunity to optimize the number of direct bookings and potentially grow its percentage of the overall channel mix in comparison to 2019 numbers. To find out more, read our article: Supporting Channel Mix Equity Through Direct Bookings.

Hospitality market trends and changing dynamics

Length of stay

According to this Forbes article, extended stays have become a major consumer travel trend because travelers are looking to make up for lost time in 2020 and 2021 when they couldn't travel. But the pandemic also pivoted much of employees worldwide to work more remotely, and this has unleashed them to pursue a more digital nomad lifestyle and workcation options.

For hotels and destinations, it is recommended to think about how to entice or reward travelers based on the length of their stay, since over half of global travelers say they are seeking longer trips of 14 days or more. Consider steeper discounts or more significant value-added services on long stays.

Also be considerate of what each segment will need for a comfortable and safe stay like hygiene amenities, extra towels, or discounted services for private travel.

Business Intelligence & data for hotels

Business Intelligence & data for hotels

COVID-19 has forced hoteliers to rethink their approach to business intelligence data and how and when it should be used to monitor performance and to refine strategies. Historically, hoteliers would rely on one or two historical data sources and then leverage a forecast to determine booking, channel, and segmentation trends in their market. Before the pandemic, booking trends were much more predictable.

However, what happened in 2020 will not be representative of what is going to happen in the future. Traveler trends are constantly changing and without comprehensive data - from multiple reliable sources - your market view will be incomplete and inaccurate.

Business Intelligence & data for hotels

Ensuring your data is high quality

The first step to stay ahead of the curve is collecting as much high-quality data as you can about future traveler booking trends to fully understand how these new changes are going to affect your revenue strategies, so you don’t have to guess.

Aggregating year-over-year historical data to predict what future trends will look like is no longer effective. Hoteliers need access to data that can present an accurate picture of what’s going on in their markets in real-time and in the future.

“This pandemic was a big wake-up call for hoteliers because forecasts based on historical data are no longer relevant. The rush to return to travel; is not going to follow normal milestones like seasonal changes or major events so hoteliers need to keep a very close and vigilant eye on the future. The most valuable data any hotelier can have right now is when it represents future business that is on-the-books, and then integrating that data alongside pre-pandemic trends to gain a factual and more realistic view of their place in the market.”

Frederic Toitot - CRME Chair Revenue Optimization - Advisory Board HSMAI

Five critical attributes make up the highest quality standard of market data you should be looking at before you make any revenue decisions:

- On-the-books (OTB): Data that is a confirmed hotel reservation, not a forecast.

- Forward-looking: Data that shows information about business booked for future stay dates, and not a projection or forecast of when bookings may happen.

- Sanctioned: Data that is extracted in partnership with the provider.

- Segmented: Data that has significant depth levels of segmentation, market, and traveler attributes.

- Fresh: Data that is refreshed frequently, preferably daily

5 Ways Forward-Looking Demand Data Can Boost Your Hotel’s Revenue

Explore how to:

- Make smarter group decisions

- Drive bookings to your brand channel

- Create the right mix of business

- Optimize prices to drive maximum revenue

- Take control and expand demand

Business Intelligence & data for hotels

Taking a comprehensive approach to data

Data holds the key to many of the challenges hoteliers are facing, as it provides revenue managers with a central window through which they are informed about what is working and what needs rethinking.

It is recommended to understand:

- How has demand changed in your market?

- What data will be most relevant for you to understand what future demand will look like?

- What data will help you map out segment and booking behaviors for each stage of recovery?

Combining both historical and forward-looking data that shows on-the-books business in your market will be key to your success.

Comparing future booking patterns that are trending to prior years like 2019 instead of 2020 and identifying potential future demand peaks will also allow you to stay ahead of the competition. And analyzing every bit of data about what’s going on in the future will help you make more confident business decisions.

Data will give insight into which business and operational pivots should be adopted for the longer term and which can be left behind as guests display new booking and behavioral patterns. It is central to activate the right mix of distribution channels at the right time. As with anything though, data needs perspective, and ensuring that it is delivered from trustworthy sources, understood correctly and then acted upon, is critical.

Business Intelligence & data for hotels

Creating a flexible pricing strategy

An effective pricing strategy requires flexibility. In an unstable market, it’s a common reaction to want to dramatically reduce your hotel’s average daily rate (ADR) to boost near-term revenue. While significantly dropping ADR may be a temporary solution, it can take much longer to recover from.

If the pandemic has taught the hospitality industry something, it’s that a pricing strategy that’s solely based on RevPAR won’t be enough to maximize profitability during recovery and beyond. It is recommended to think beyond the guest room as the main source of revenue, and expand strategies to focus on the total profitability per available traveler.

Keep in close partnership with your marketing and sales team to:

- Identify all your incremental revenue offerings and opportunities for every traveler segment, and then see how you stack up against your competition.

- Take stock of any partnerships with other local businesses and outlets that can add to your offerings and diversify your property in your market.

- Design new packaged offerings or value add services based on your target segments across each recovery phase.

Make sure the operational teams can support these new offerings and packages at scale so as not to inflate operating costs and to ensure a memorable guest experience.

Revenue Management Playbook

- Target the most valuable traveler segments for recovery

- Build the right pricing strategies for future growth

- Differentiate your offerings while protecting rates

- Identify high-quality business intelligence data

Business Intelligence & data for hotels

The shortened booking window

One result of the pandemic has been last-minute hospitality bookings as the nature of people’s travel changed. At the height of the first wave of infections in April 2020, 62% of all bookings globally were made within seven days of travel.

This made staff scheduling, revenue management and planning considerably harder as hotels struggled to predict how many guests they would be accommodating day to day. However, new data in recent weeks indicates the booking window is once again lengthening as traveler confidence returns. Although nowhere near the level of pre-planning the industry is accustomed to, it’s a welcome step in the right direction.

To maximize your profitability as travelers begin to book farther out, don’t just set room rates or value-add offers only to forget them. Continuously monitor the booking window across your most profitable segments to identify any trends that point toward demand growth.

A good first step is to gather as much forward-looking occupancy data you can about how lead times look in your area and region. Pay close attention to hotels that are driving strong rates within those short lead times.

Business Intelligence & data for hotels

The future of hotel Business Intelligence

Up to now, hotels have built forecasts and planned their strategies heavily based on occupancy estimations, historical data, screen scraping, and other inconsistent data gathering tactics.

This situation has made them ever more susceptible to inaccuracies due to market fluctuations and unexpected selling rate changes & closures.

In this context, hotels need to adjust to the new paradigm:

- Firstly, hotels will discover the growing need to develop a forward-looking, data driven revenue strategy from sanctioned rate shopping data to achieve more profitable pricing strategies. This will allow them to quickly identify and analyze: under-performing segments, pick-up, market shifts and demand changes.

- Keeping visibility on their multiple competitive sets will also be key to stay ahead of the curve. This will be enabled by tools that allow to compare hotel's forward-looking pricing against their competition and by monitoring their rates, demand, and penetration in their market or location.

- Relationship with travel agencies and appearance in GDS will also remain a key revenue driver in their distribution channel mix so hotels will continue to achieve their fair share in the GDS marketplace and continue to improve their relationships with travel agencies.

- Data will increasingly become the most valuable currency, not only because it allows hotels to maximize profitability but also to stay ahead of the competition. By having access to the right data at the right time, hotels will accelerate revenue for long term growth with ease.

Without having the right data about your market at the right times, improving your revenue strategy can become challenging. The key to successful revenue growth in today’s competitive landscape is always having deep data visibility into your market. Check out our infographic that shows how pervasive and forward-looking our business intelligence market data is within our solutions to help you maximize your revenue.

Business Intelligence and data for DMOs and CVBs

Business Intelligence and data for DMOs and CVBs

The travel industry is evolving, and so too has the way we all make data driven decisions. There is a growing need for Destination Marketing Organizations (DMOs) and Convention Bureaus Organizations (CVBs) to access all the data and insights needed to quickly make the most profitable, strategic decisions for their business.

Business Intelligence and data for DMOs and CVBs

Data Challenges for Today’s DMOs and CVBs

DMOs and CVBs face different challenges and objectives, but most revolve around gaining a better understanding about who is travelling and how they are travelling to different destinations.

The main challenges they face revolve around having:

- An incomplete view of the travelers’ journey encompassing who the visitors are, where they are coming from, what routes they take, and what they do while traveling.

- Multiple, and often incompatible, data sources that must be patched together.

- Difficulty in understanding market performance and an over-reliance on historical data that misses upcoming trends.

- The inability to gain insight on the competition and understand what they are offering and how travelers make travel decisions between competing locations and services.

Business Intelligence and data for DMOs and CVBs

Not all data is created equal for DMOs and CVBs

All data sets are not created equally, so it is important for DMOs and CVBs to think about the problems they want to solve and the questions they want to address and the margin of error that is acceptable. You can’t see the future in a rearview mirror.

- Historical is just that – historical.

- Artificial Intelligence & Machine Learning alone only tell part of the story.

- The past no longer fully represents the likelihood of the future.

Understanding where business is coming from allows DMOs and CVBs to better allocate resources accordingly and shift marketing efforts to the most profitable channels. Here are 4 tips to help you improve your marketing mix with hospitality business intelligence.

Finally, centralizing data across multiple data sources is key. Building connections and exploring relationships between how travelers travel and what they do when they get to a destination helps inform business process.

Business Intelligence and data for DMOs and CVBs

How to uncover insights from search to stay

A comprehensive understanding of the different actions travelers take prior to arrival is foundational for DMOs and CVBs to drive more business.

By combining Air and Hotel data, you can uncover the most comprehensive insight into how travelers research, plan and arrive at your destination.

Data Options Available:

Travel Agency Hotel Booking Data: The only comprehensive database of GDS bookings, providing insight into which agencies are booking your destination with 100% of data from all GDS platforms.

Hotel Occupancy Data: The hotel industry’s only comprehensive forward-looking demand data, which includes one year of forward-looking occupancy data from the world’s leading hospitality brands.

Air Data: Gain comprehensive insight into air travel patterns and trends including air search, capacity, number of flights, bookings, and arrivals.

Amadeus is uniquely positioned at the intersection of travel and allows DMOs and CVBs to develop profitable strategies to attract, convert, and retain visitors to their destination.

Click on the link below to discover the world’s most comprehensive travel data and media services.

Ready, set, leverage hospitality market insights!

Ready, set, leverage hospitality market insights!

We hope that this hospitality market insights guide was useful for you

Hospitality market insights and data can be a bit overwhelming at first, but with a little experience, you can quickly produce high-quality data-driven strategies that generate results from day one.

Market insights and data play a foundational role in helping hotels to maximize bookings and revenue. Adapting to changing market trends, leveraging the right data sources, and basing your strategies on the right data are all necessary ingredients to craft the right strategies that attract and retain more travelers to your hotel or destination.

For further reading, check out our recently published rebuild travel - revenue management eBook.

You can also access our other comprehensive guides:

- The ultimate guide to hotel marketing

- The ultimate guide to elevating guest satisfaction

- The ultimate guide to increasing guest loyalty

- The ultimate guide to grow hotel groups and events business

We wish you a lot of success in your market insights strategies, and do not hesitate to contact us if you would like to discuss how to kick-start or optimize your hotel or destination's data strategies.