Originally published on Amadeus Insights

Tourism was one of the first, and still is one of the sectors most affected by COVID-19. The UNWTO anticipated that total international tourist arrivals for 2020 would be around 70% lower than they were in 2019. However, in the second part of 2020, signs of recovery in some domestic markets across the world started to appear. In China, the promotion of domestic destinations paired with tangible policy support, such as tax breaks and financial subsidies for companies in the travel sector, have jointly contributed to the steady recovery of the travel ecosystem.

Although the uncertainty continues – with some cities and provinces in China re-introducing travel restrictions only recently lifted – the normalization of control measures, such as rapid nucleic testing and wide usage of QR health codes, means consumers’ confidence and enthusiasm for travel is gradually increasing, and the hotel industry is entering a new stage of growth.

Through Amadeus’ Demand360® business intelligence solution, Amadeus has discovered data points that offer examples of the resilience of the hospitality industry in China.

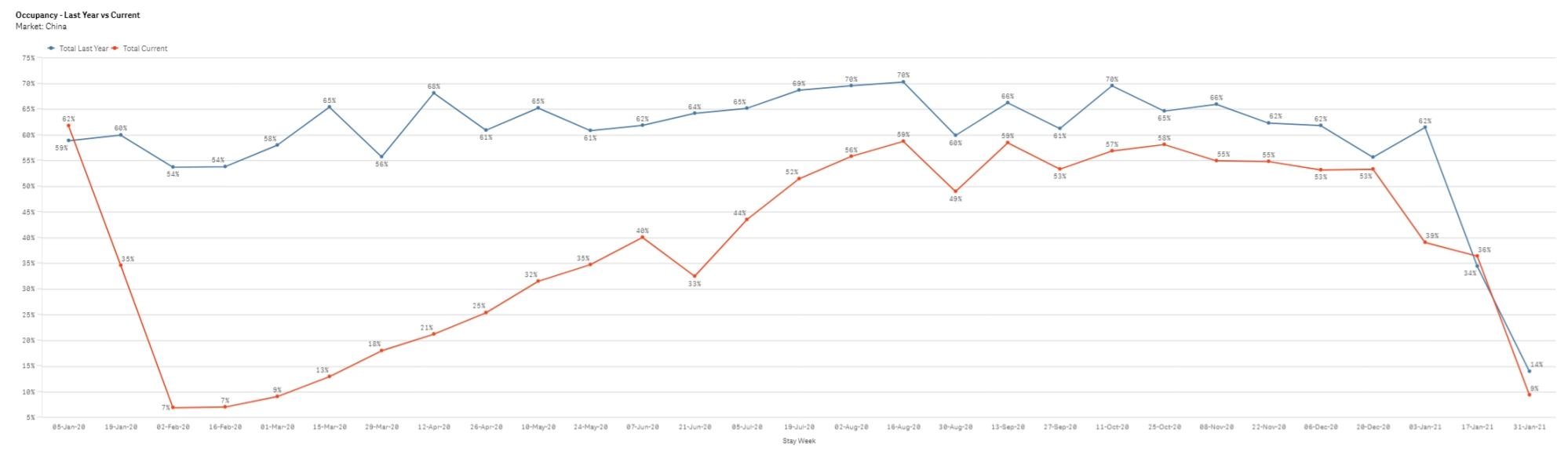

Occupancy levels are getting back to similar levels of 2019

As of last summer, with the decline of locally transmitted COVID-19 cases, the introduction of prevention and control measures and series of successful promotional campaigns of domestic destinations by the local provinces, data shows that more people felt comfortable traveling around China. Amadeus data shows a steady recovery in occupancy starting from June 2020 throughout the second half of 2020. In some instances, such as China’s National Holiday in October 2020, the occupancy rate reached the same level as back in 2019, and for the week of 6th September 2020, the occupancy was higher than the same time period in 2019.

However, due to the new micro-outbreaks in some Provinces after the New Year holiday, and the introduction of cross-provincial travel control measures, the occupancy in January of this year has widened compared to the same period last year.

Source: Demand360® data as of January 24, 2021. This chart shows data from January 5, 2020 to January 24, 2021. (click to enlarge)

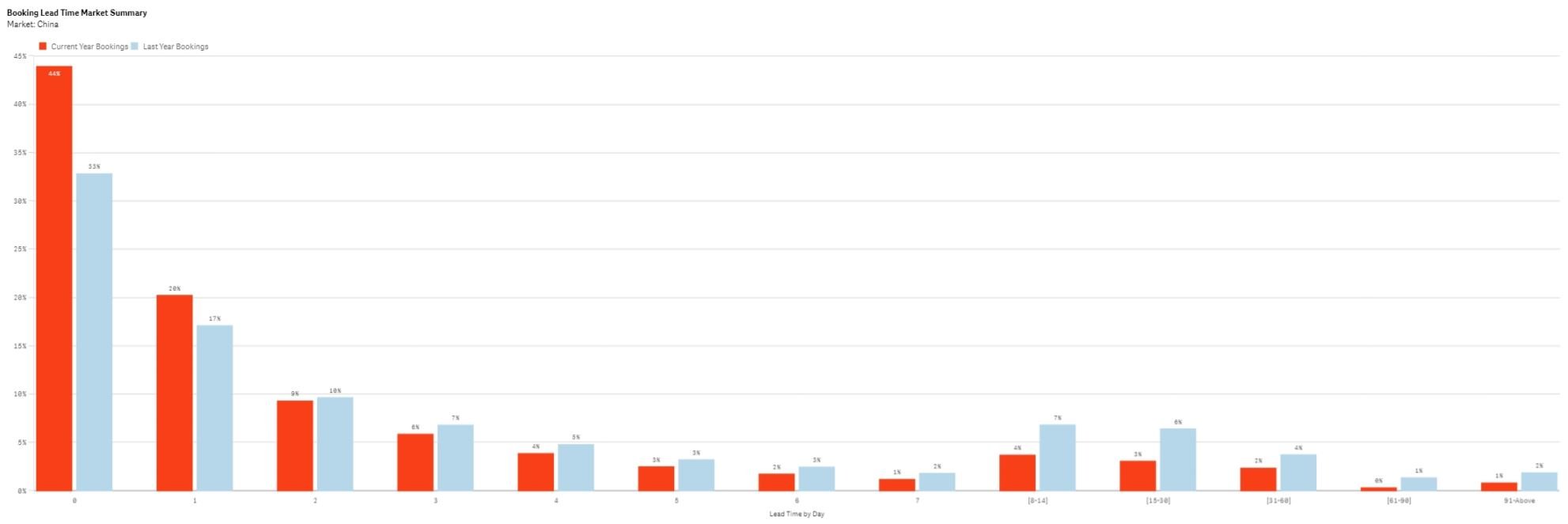

Chinese travelers prefer significantly shorter booking lead time

Given the rapidly changing travel restrictions, due to the micro-outbreaks, and constantly evolving regulatory requirements for cross-provincial travel, planning a trip has become even more complicated. Compared to 2019, 2020 saw a significant increase in the bookings that were done between 0-2 days, with an 11% increase in bookings made on the day of travel. Meanwhile, the long-term planning between 8-14 and 15-30 days declined by 3% and 6% respectively.

Source: Demand360® data as of January 24, 2021. This data looks at the five week period from December 20, 2020 to January 24, 2021. (click to enlarge)

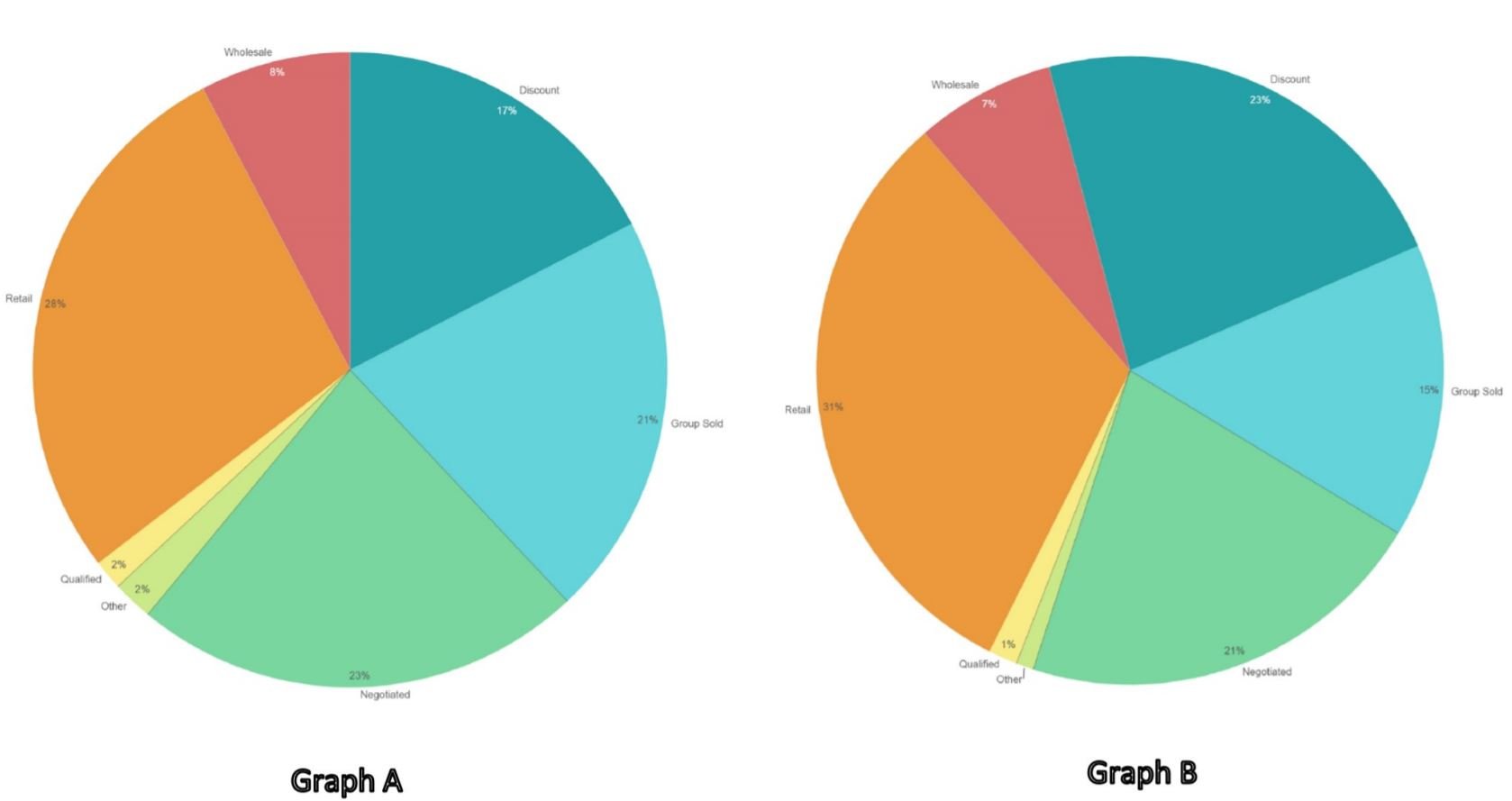

Both corporate and leisure travel are getting back on track

This year, as of 24th January 2021, we are seeing corporate travel stay stable (coming back with just a 1% decline) compared to the same time in 2020 (shown as ‘negotiated’ in the chart below). We can also see a slight increase in leisure with growth in the ‘discount’ (6%) and ‘retail’ categories (3%). However, because business travelers are booking more last minute, the growth might occur due to the spillover from the corporate travel into the other segments.

Source: Demand360® data as of January 24, 2021. Graph A refers to data range January 1, 2019 to January 22, 2020. Graph B refers to date range January 1, 2020 to January 24, 2021. (click to enlarge)

Your trusted source for industry-leading forward-looking market insight

Amadeus Demand360® is the only business intelligence solution that provides actual forward-looking occupancies for your hotel and your selected competitive sets. The data provided is updated twice per week and occupancy information represents actual rooms sold, including market segment and channel statistics, so you know who is traveling and how they are booking their reservations. If you want to know what is happening in your market contact us today.