With the UK now finally making a return to the ‘original’ normal, we take a look at what Amadeus flight and Demand360® forward-looking hotel data shows for the UK & Ireland, and how does this compare to the rest of the world?

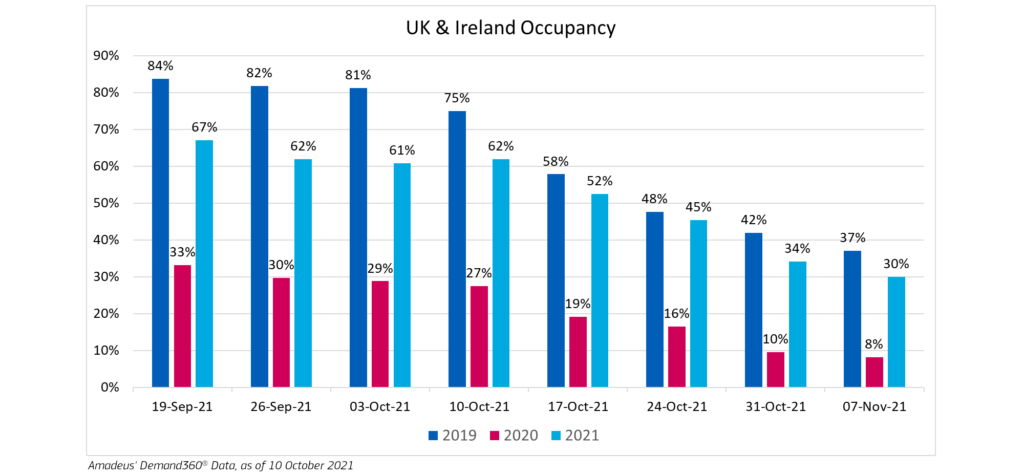

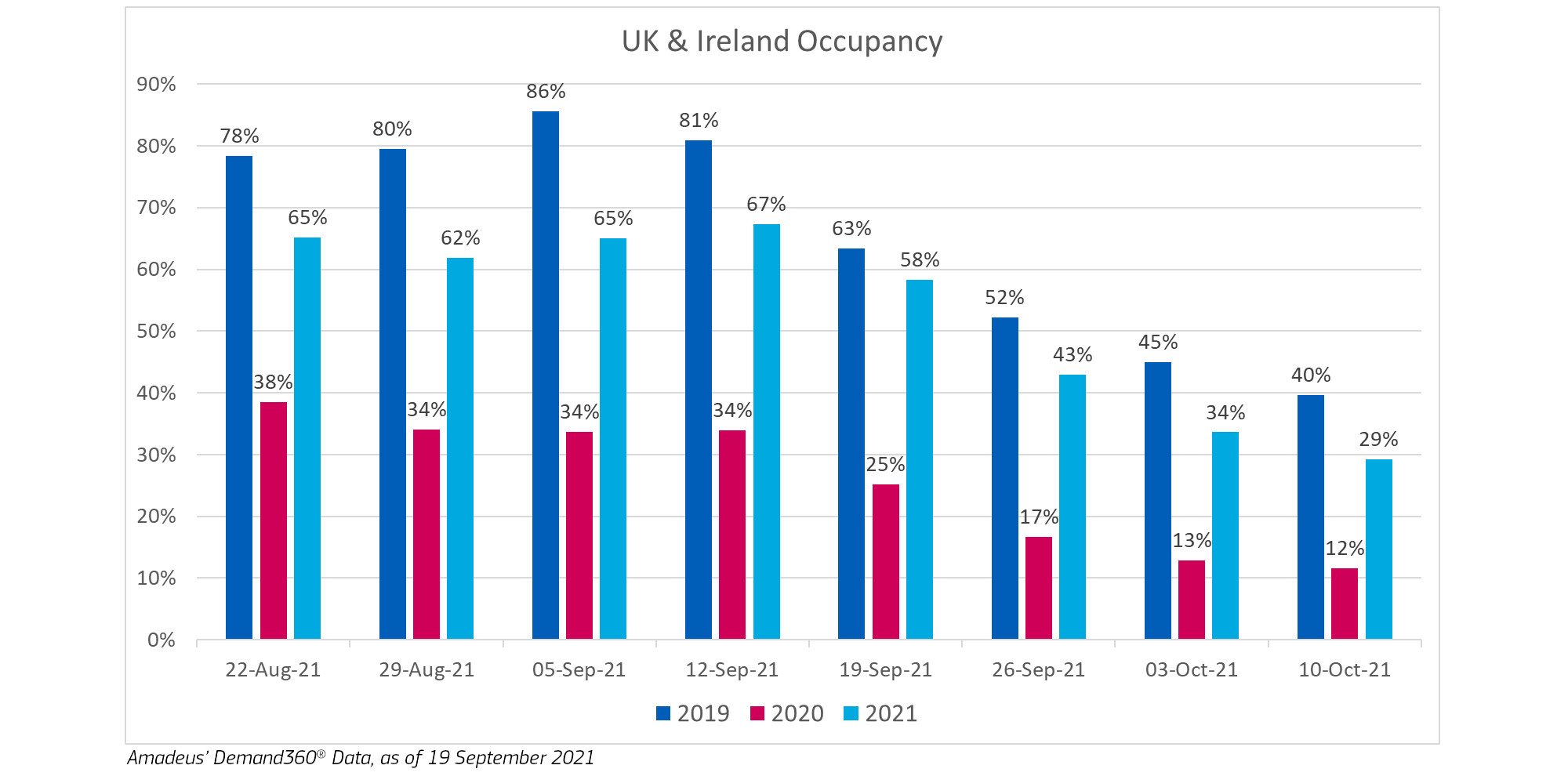

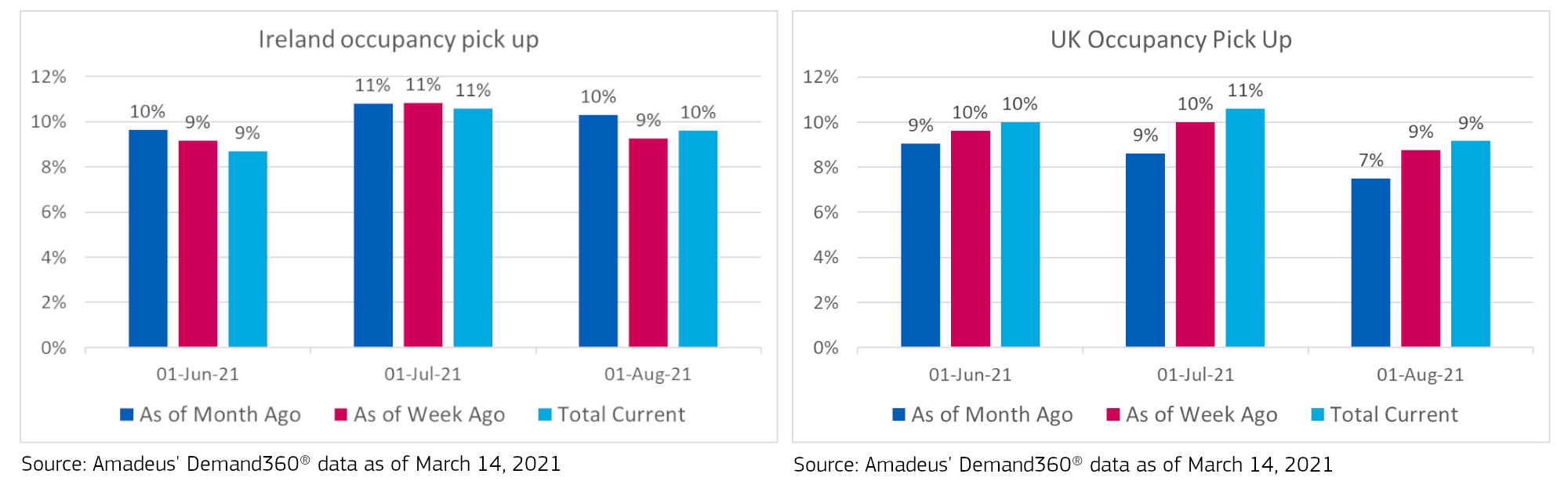

Comparing UK occupancy with other markets

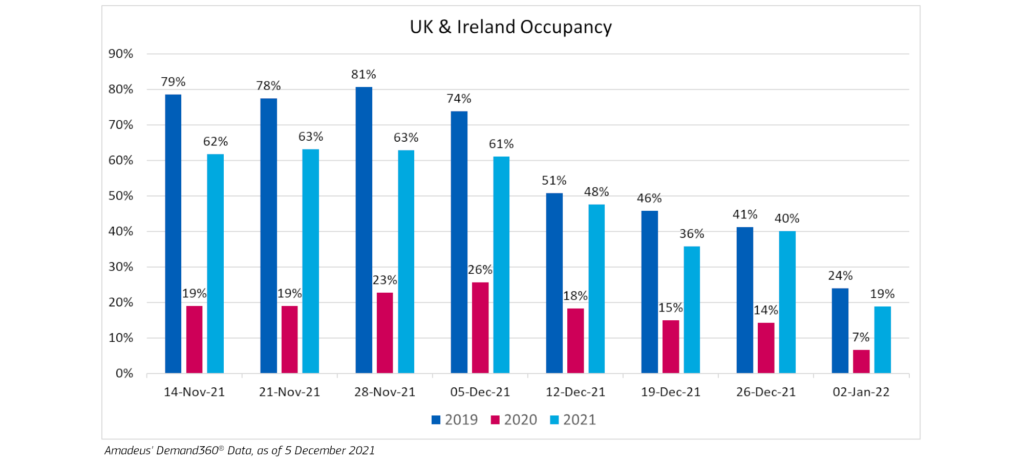

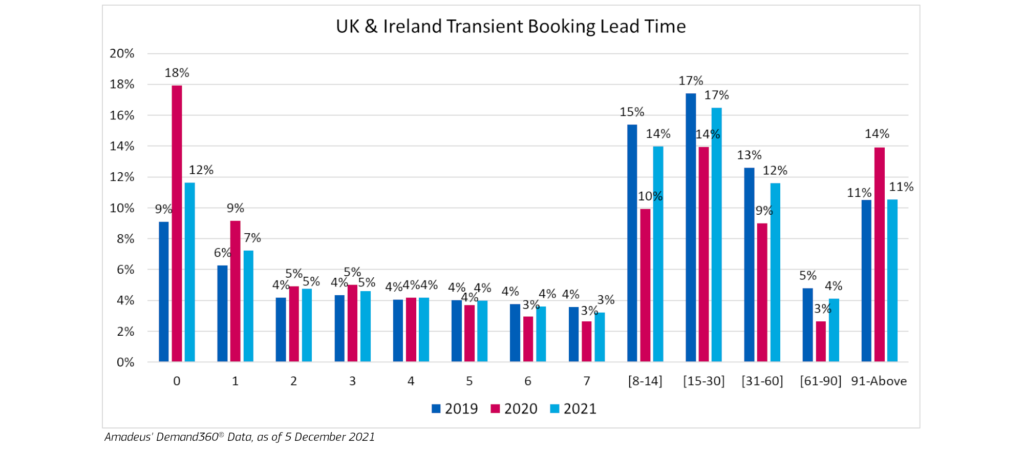

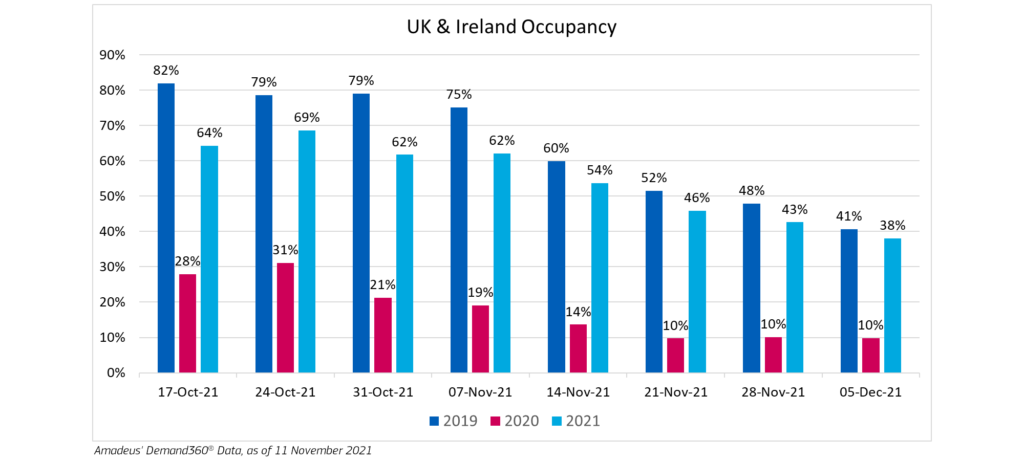

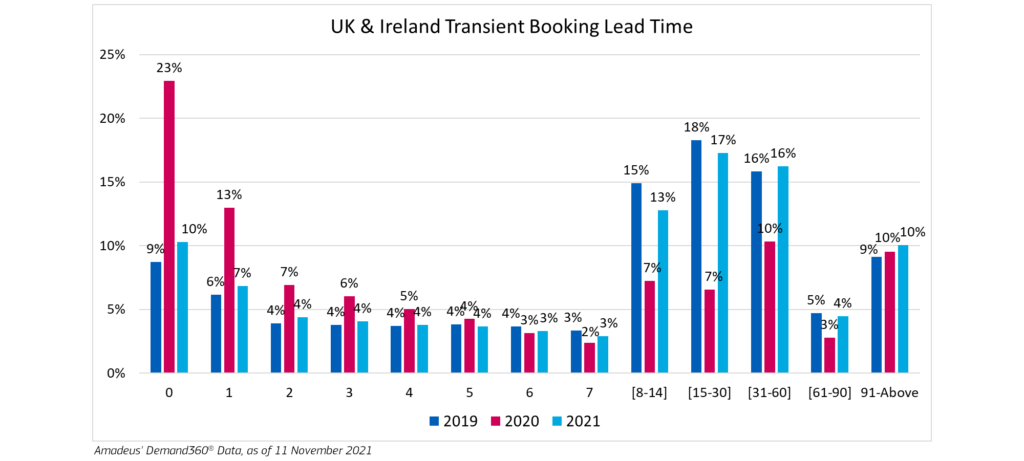

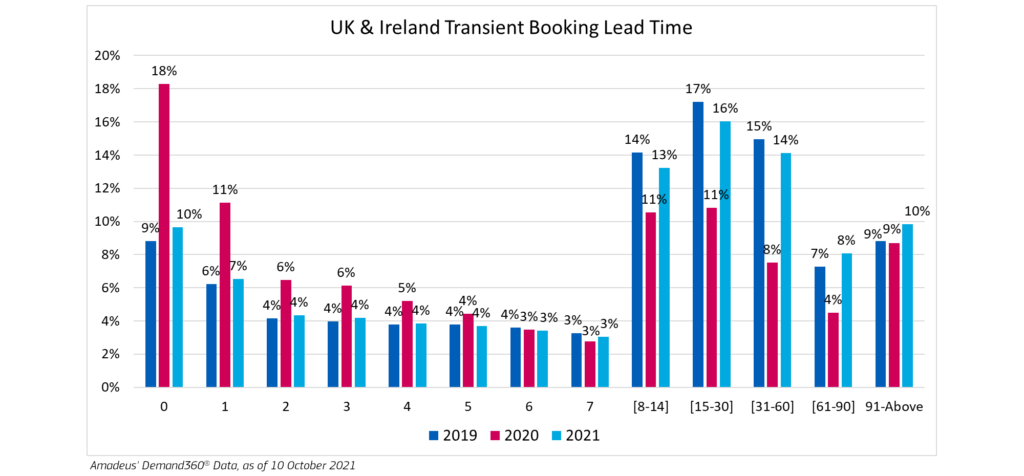

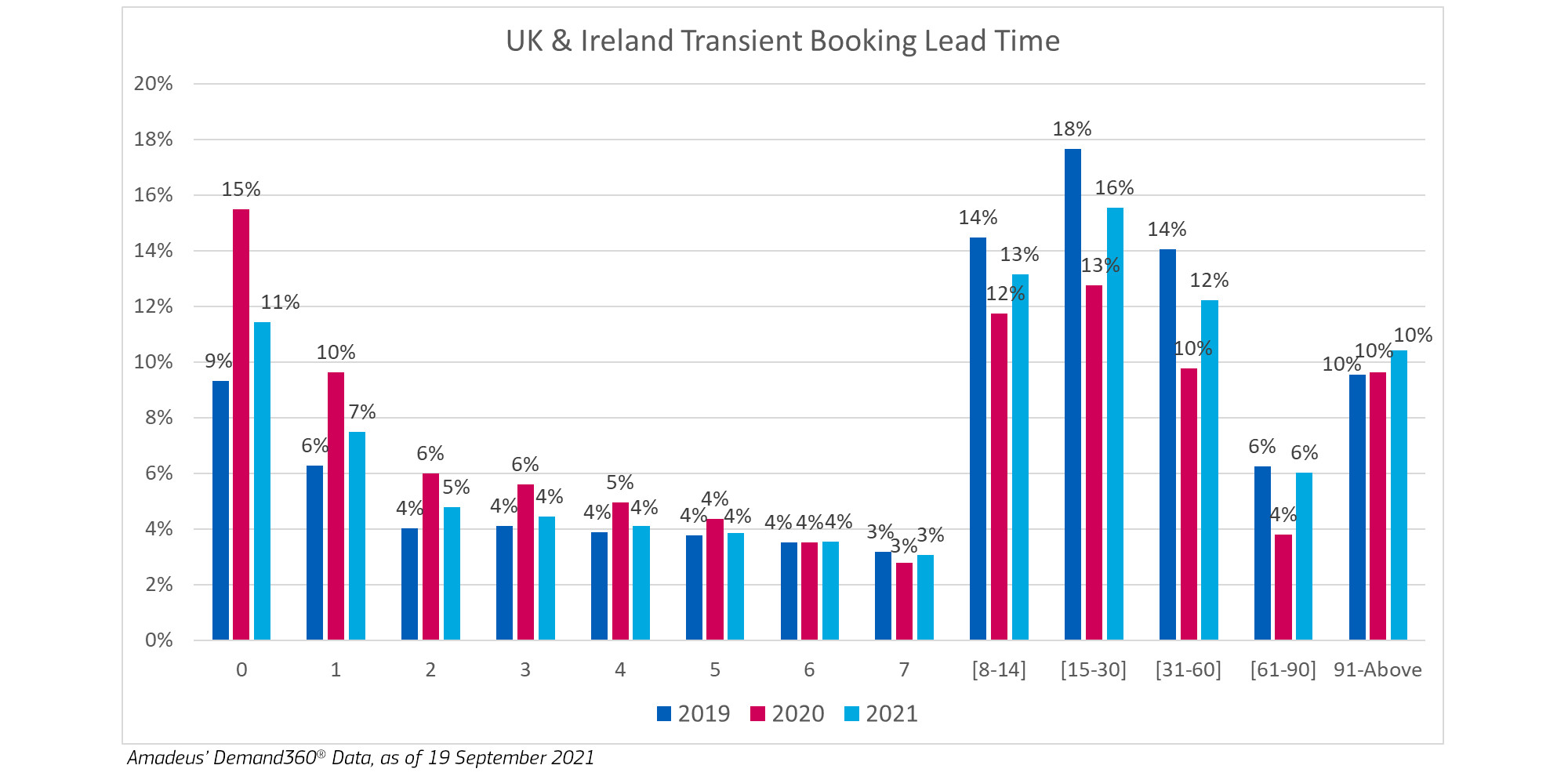

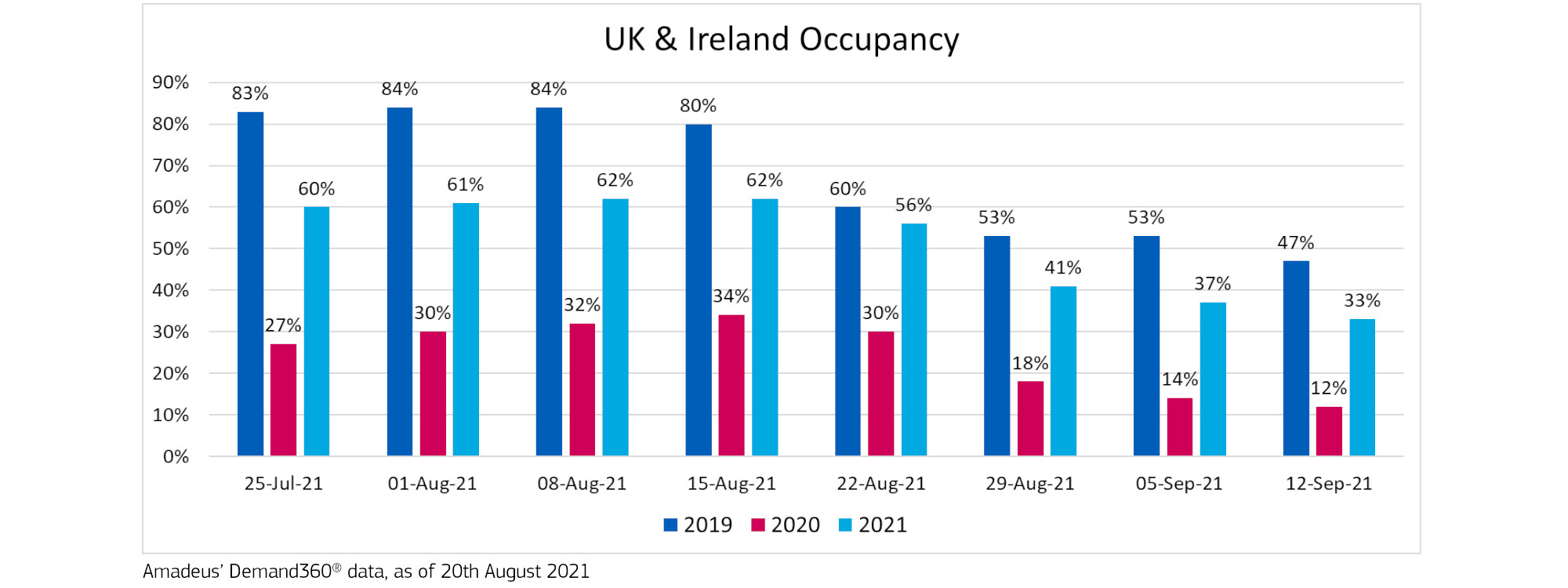

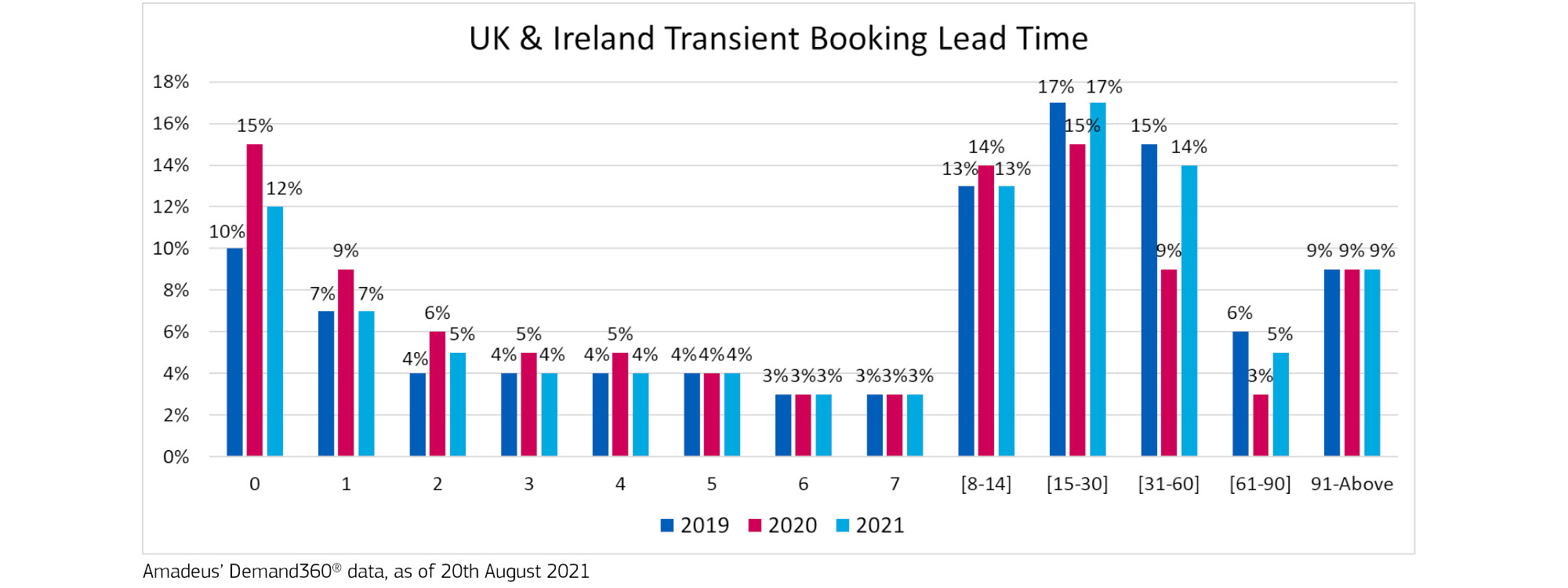

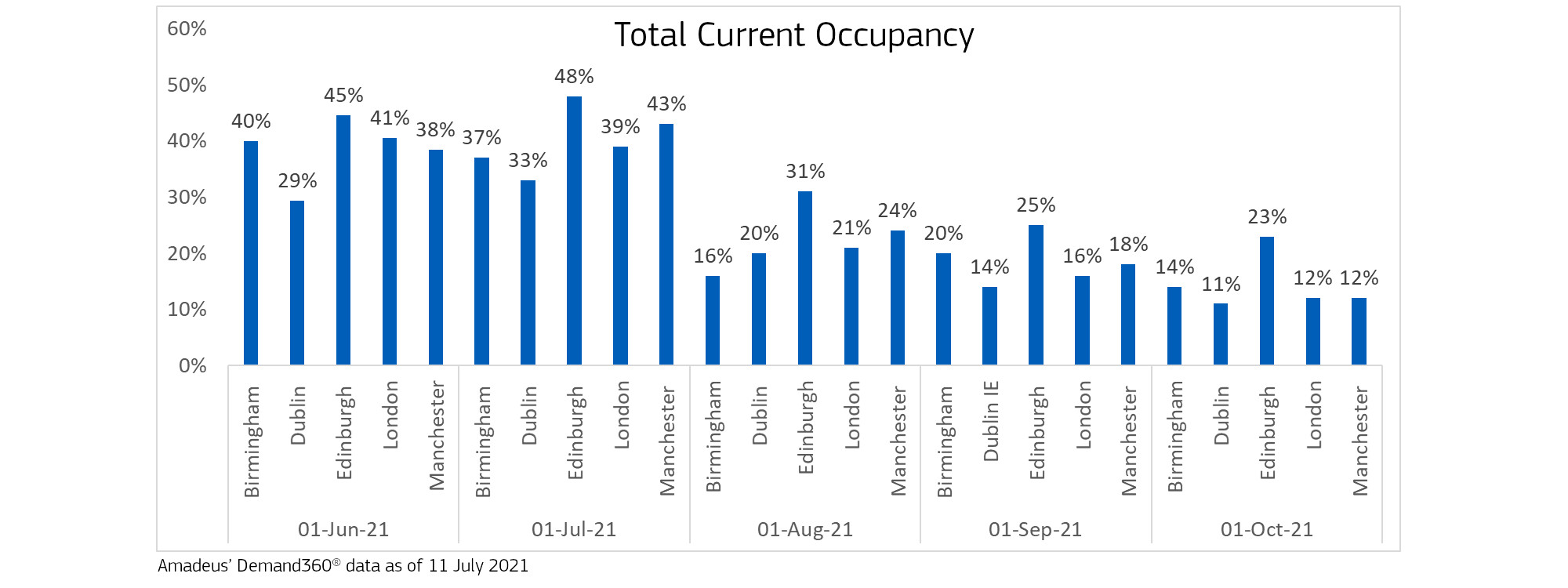

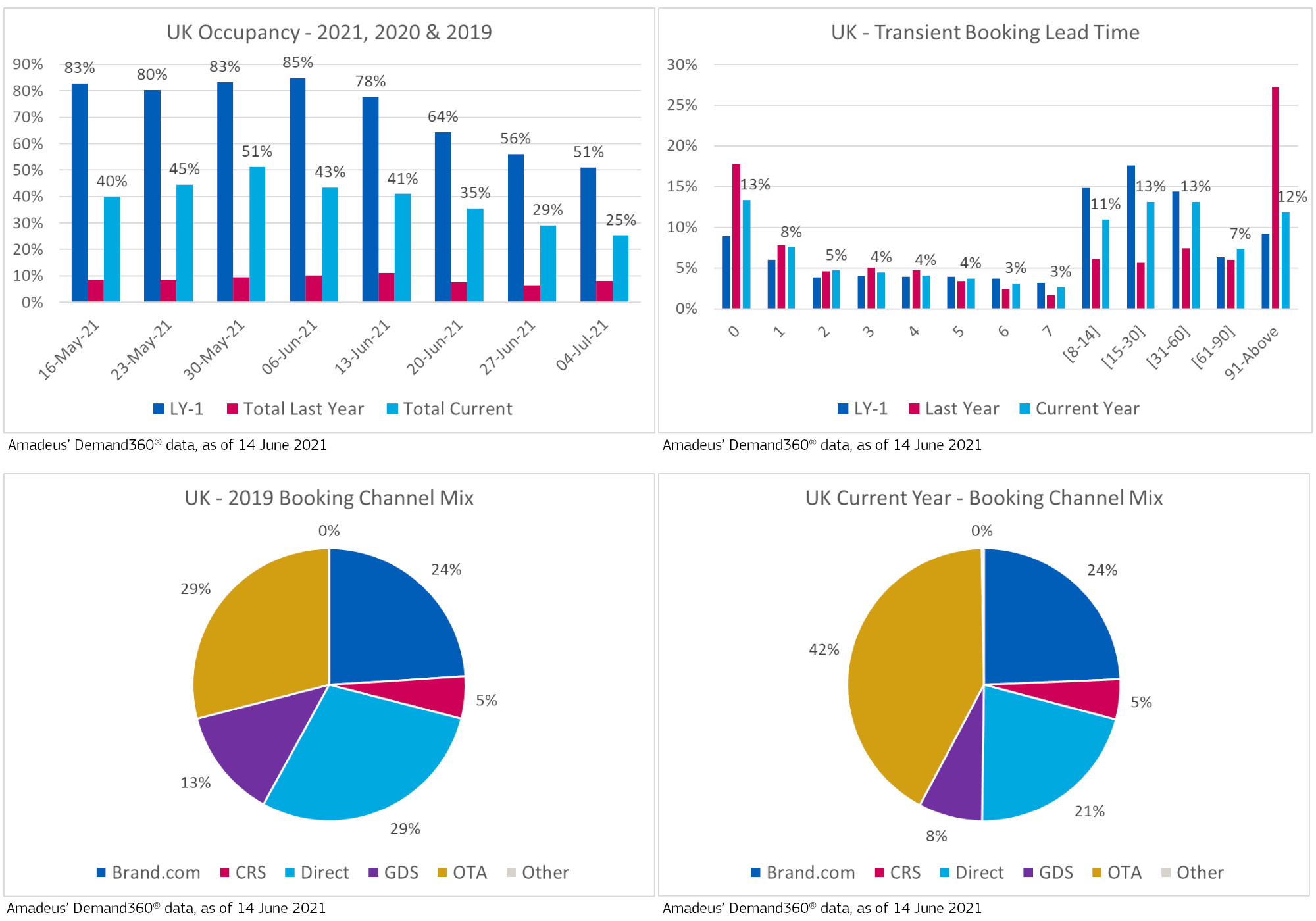

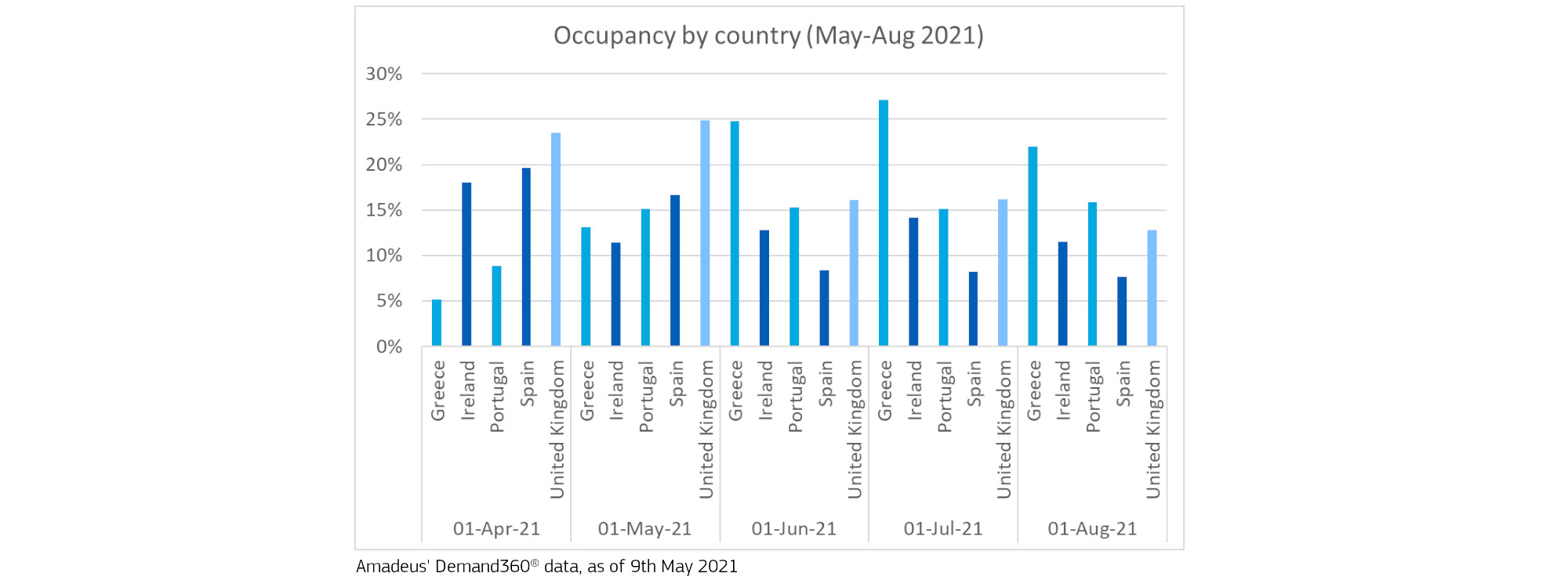

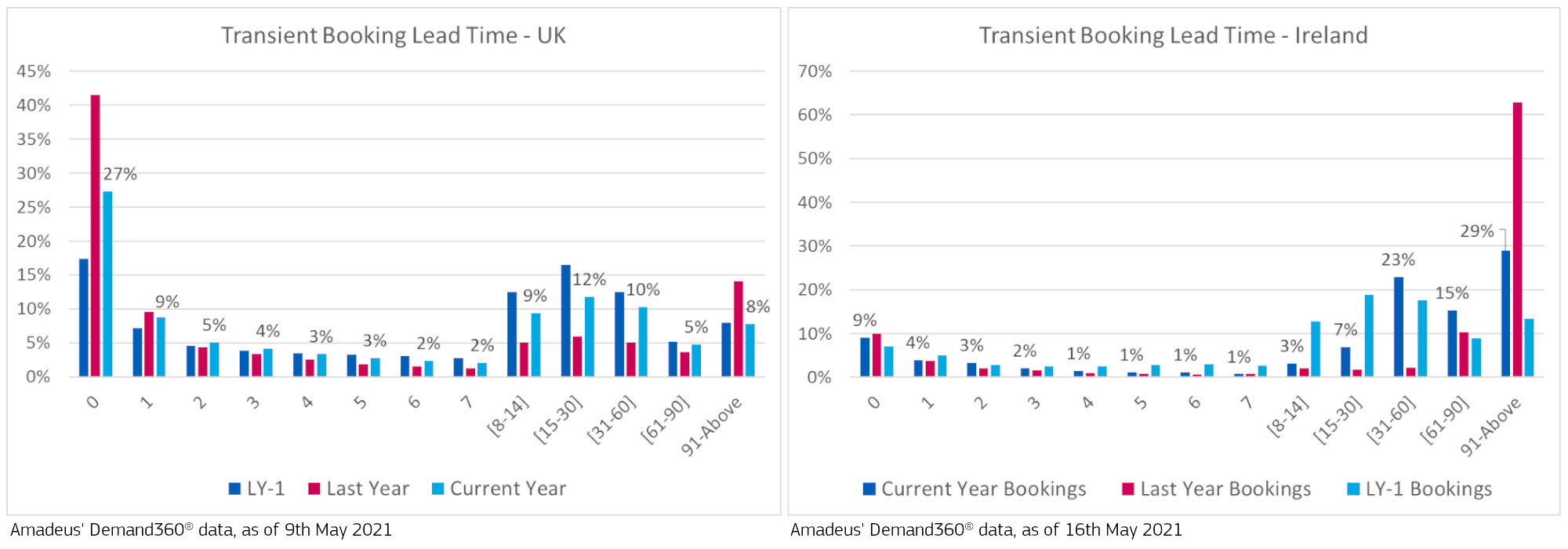

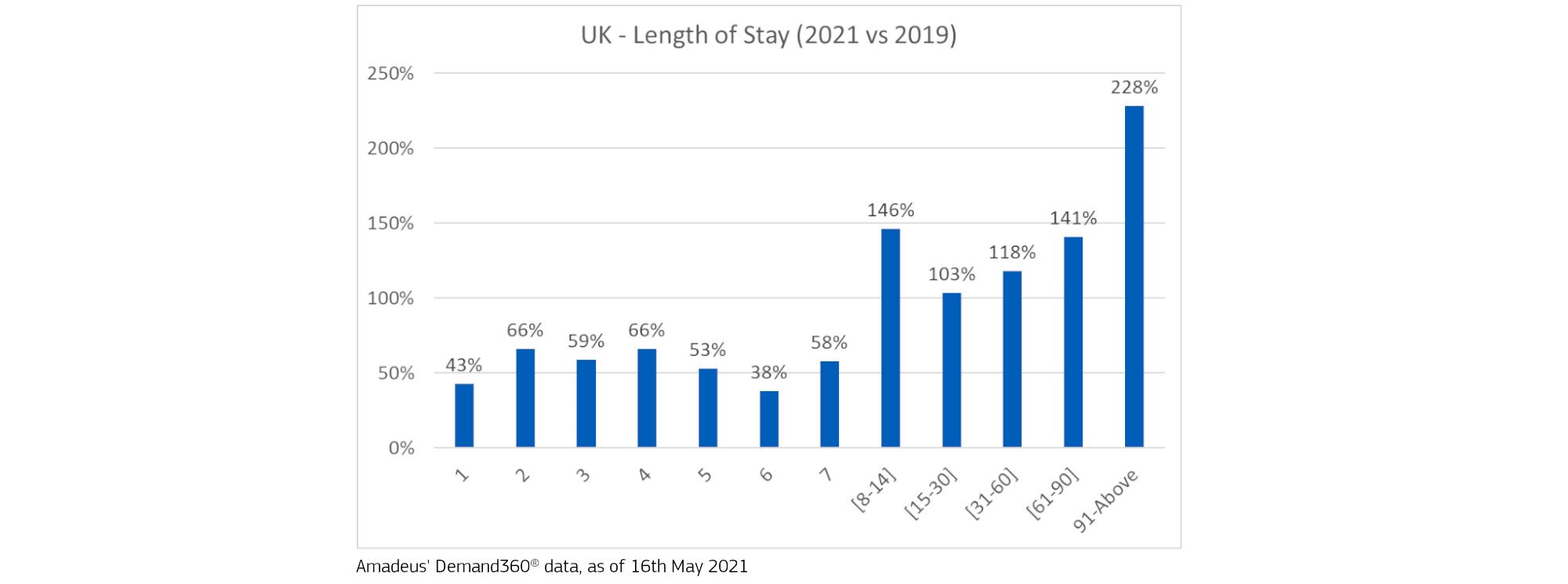

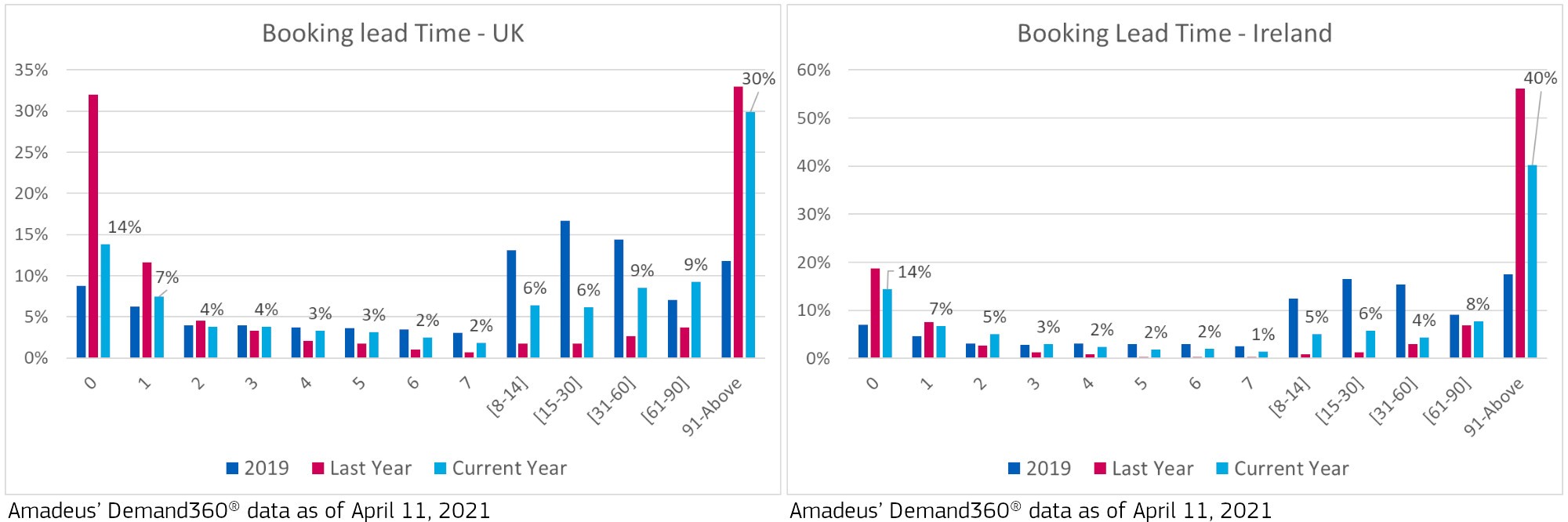

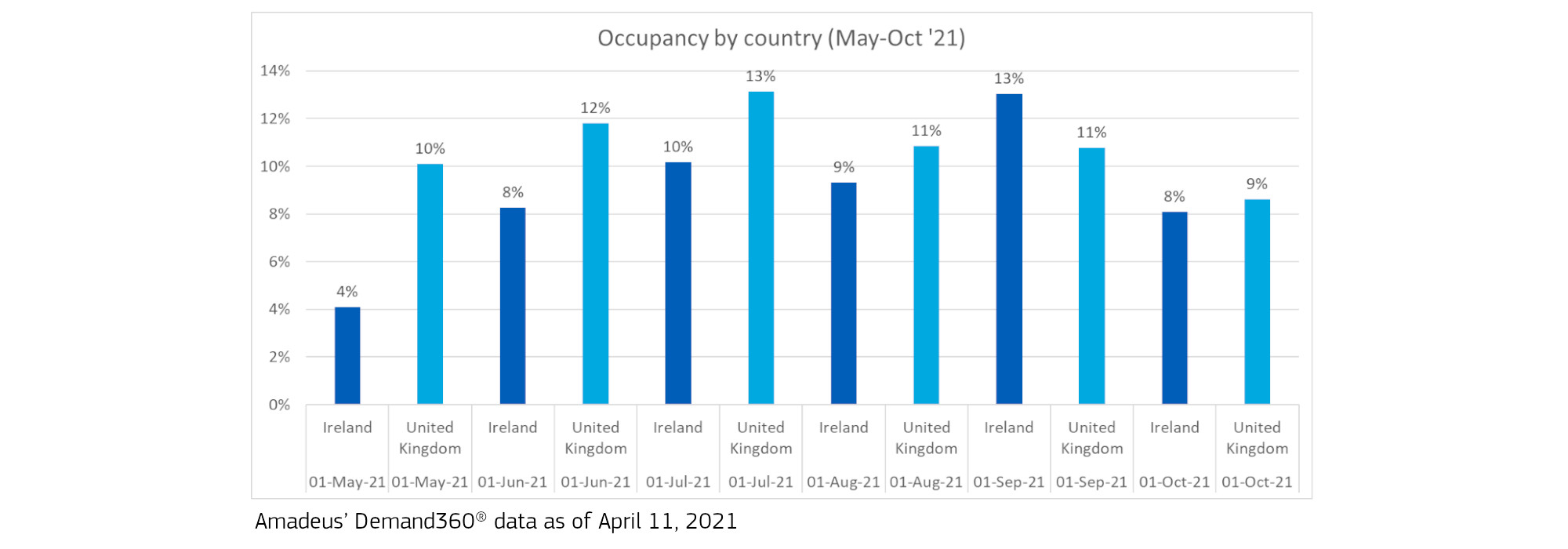

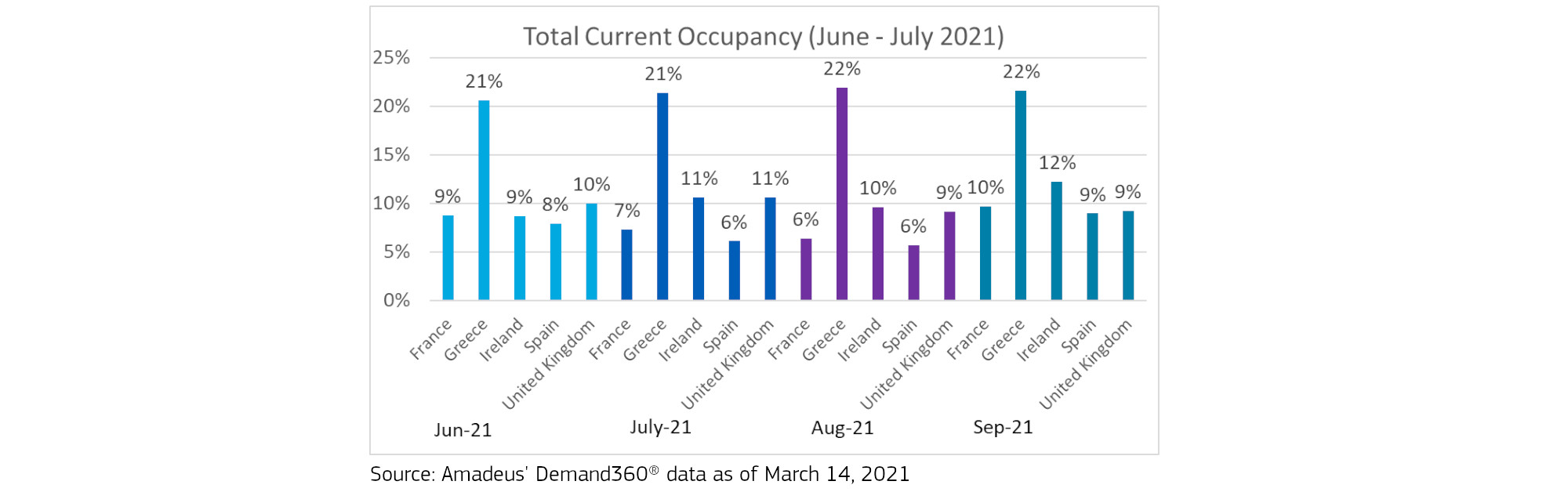

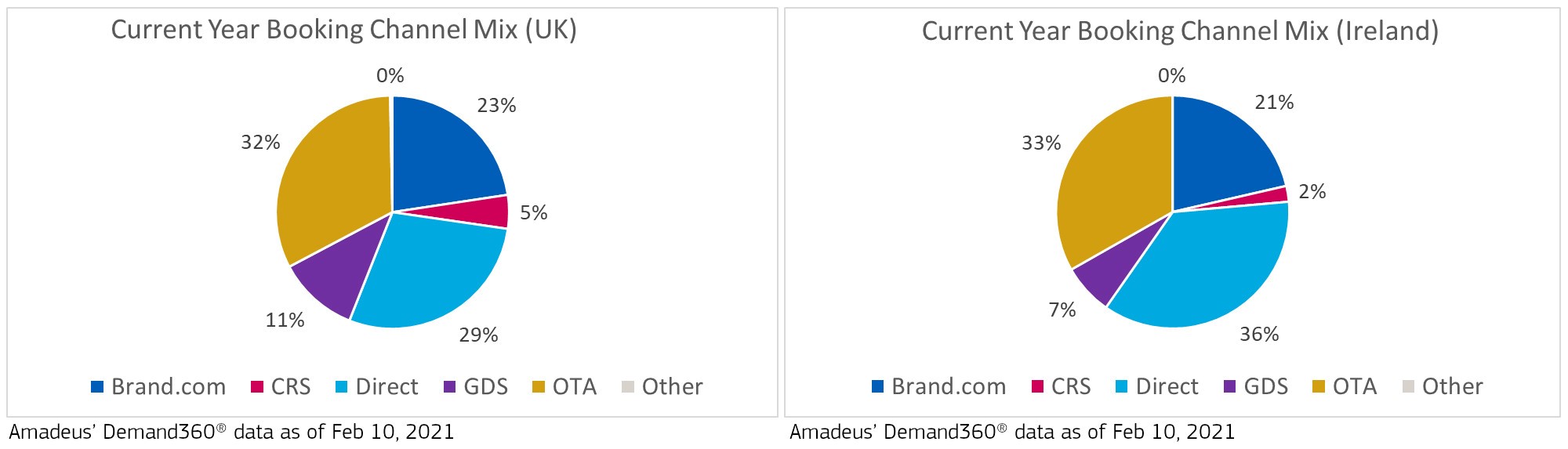

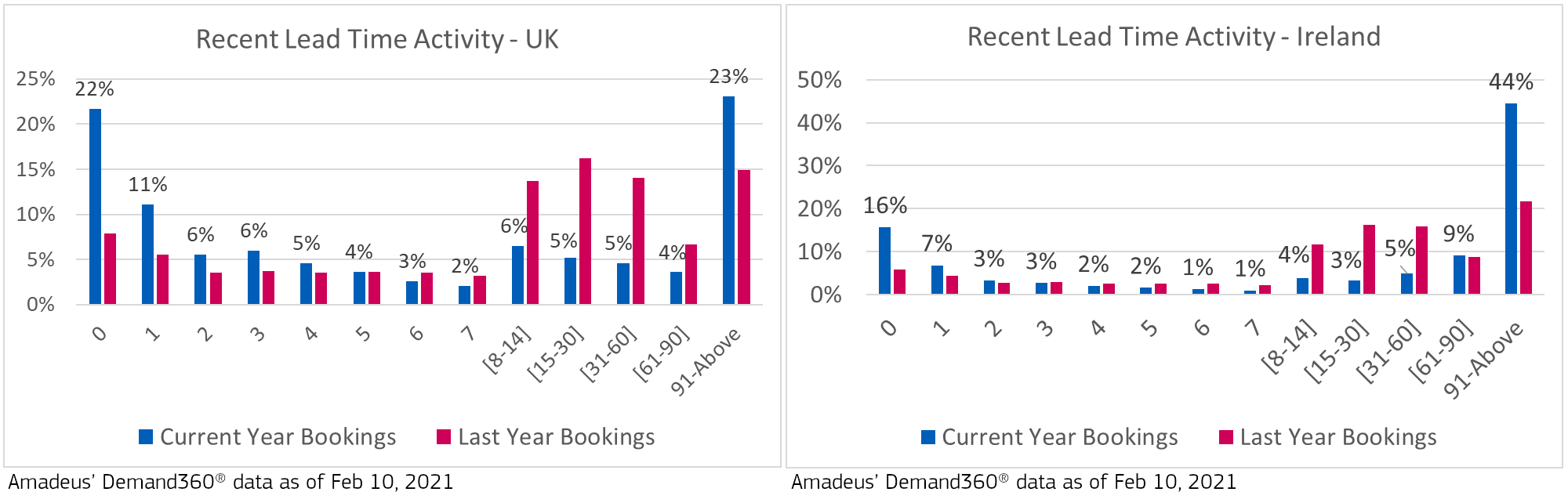

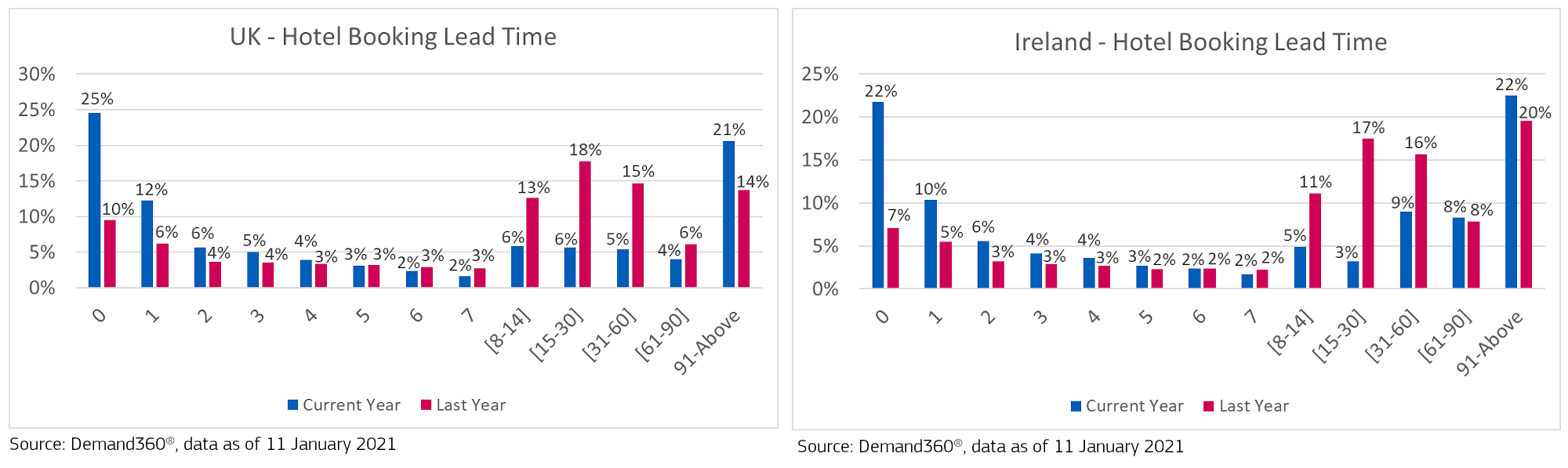

Depending on your location in the world, levels of restrictions might look very different. Occupancy levels reflect this. For instance, with much of America now resuming everyday life, occupancy across North America has been averaging 50-60% since May. China too, with recent holidays and a growth in domestic tourism spurring travel, also reached highs of 50-60% as of March. As for Europe, with much of the continent facing ongoing restrictions and a resurgence of the virus, occupancy peaked at 34% in June, and is set to meet the same level in July. If we drill down into key markets across Europe, between the months of February and October, UK is leading the way in terms of occupancy, with highs of 45% in June. For each of these markets, numbers drop the further out we look. This makes sense considering the ongoing trend of reduced booking lead time. In the UK, 45% of bookings are still made within one week of check-in.

Looking ahead to September, what about key cities?

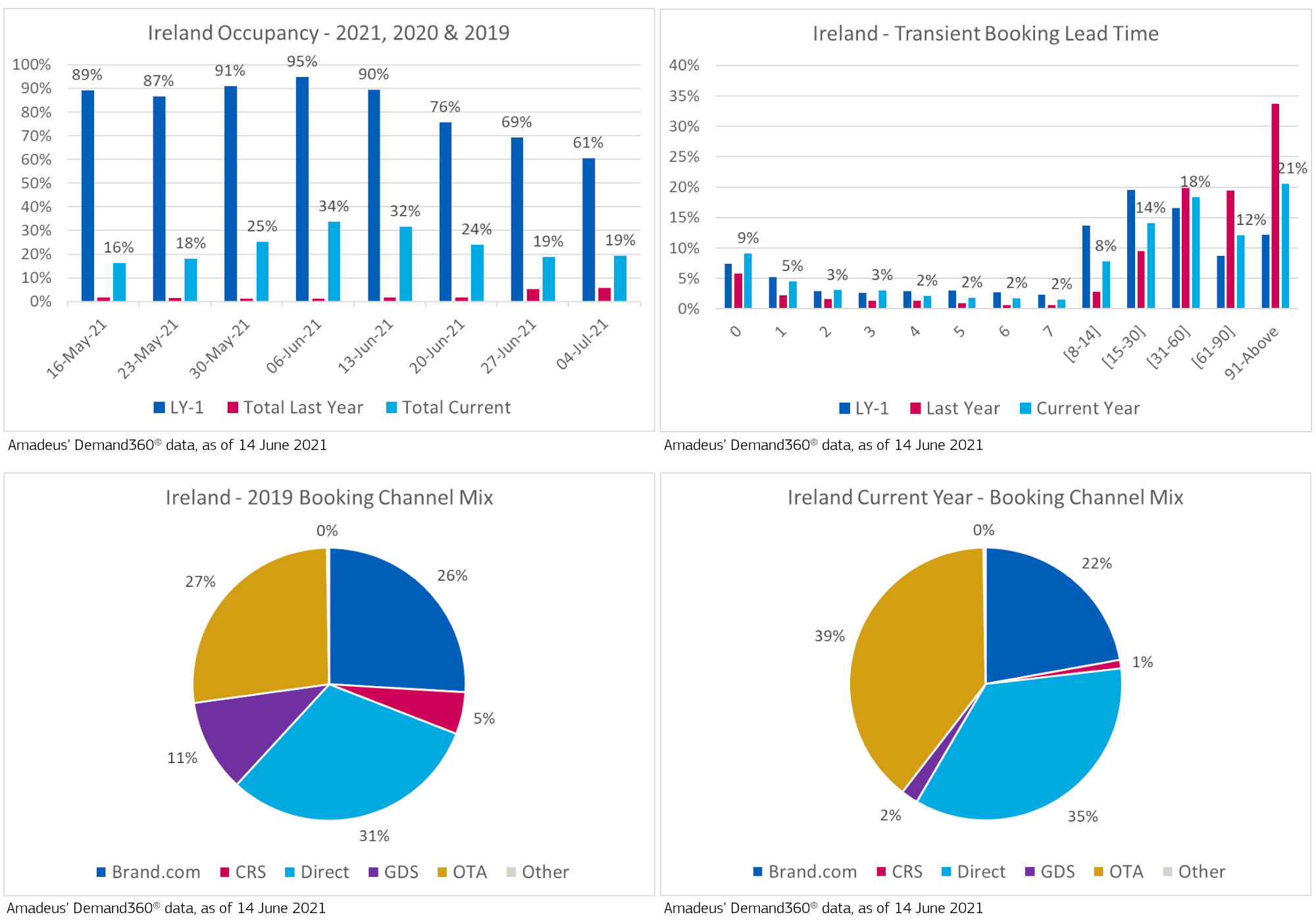

As the UK and Ireland reopen in July and August, the expectation is that many will return to the office in September. Aside from that, as restrictions ease, activities most associated with cities, such as theatres, nightlife and events, are set to come back. In fact, current Demand360® data seemingly confirms a growing interest in city travel. In the months of June, occupancy in Edinburgh reached 45%, with London and Birmingham close behind at 41% and 40% respectively. July is set to follow this trend, with Edinburgh’s occupancy at 48%, according to data from 8th July. Considering the UK overall is averaging 40% in June and July, this is a positive sign of recovery for big cities. Dublin is still lagging behind others, but as Ireland continues to reopen, hoteliers should keep an eye on how this evolves.