Brits have been enjoying some summer weather over the last few weeks, with temperatures soaring across parts of the UK & Ireland. But the weather is not the only thing impacted by the summer months, it is also known to be the peak time for travel. So how is the arrival of Summer impacting booking trends across the UK & Ireland? We explore what Amadeus’ Demand360® and flight data is showing us.

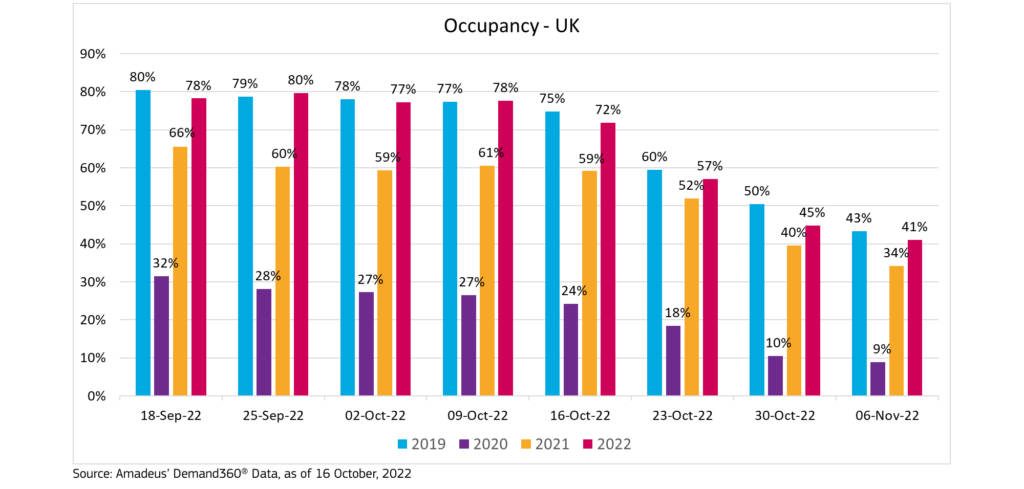

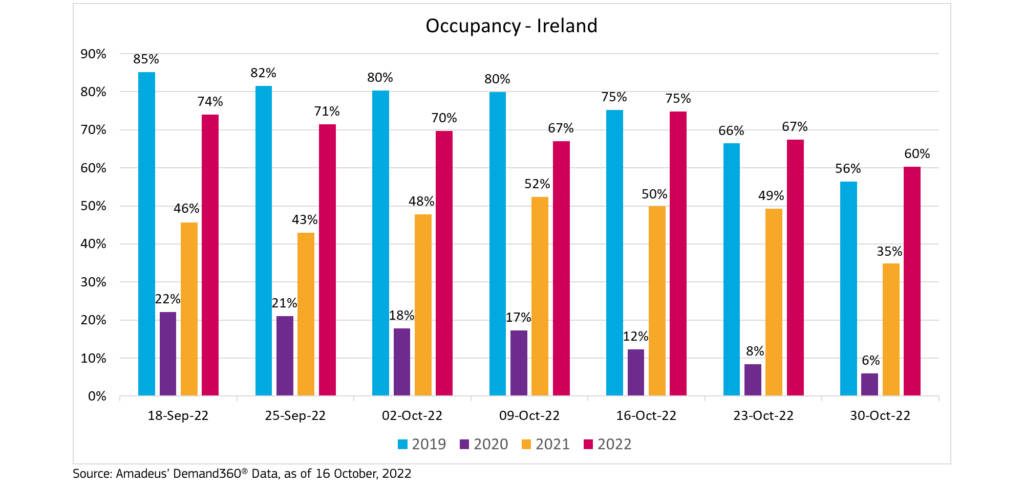

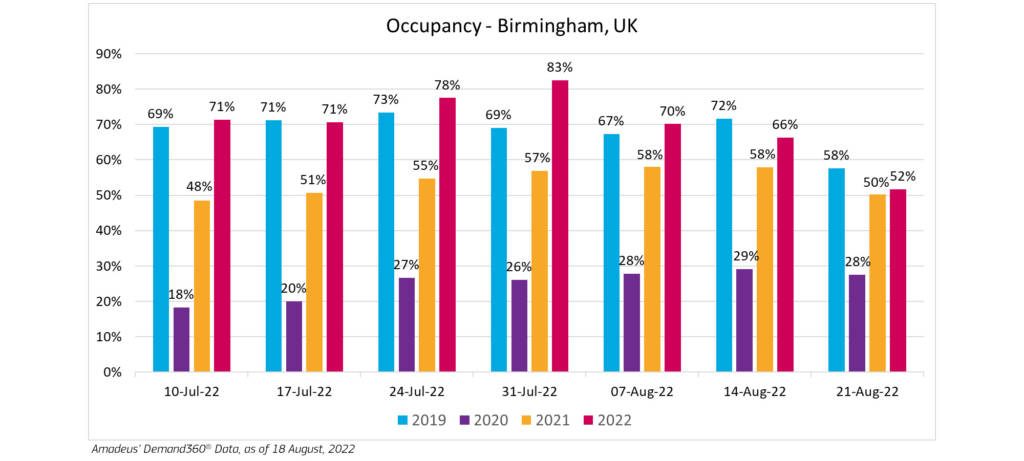

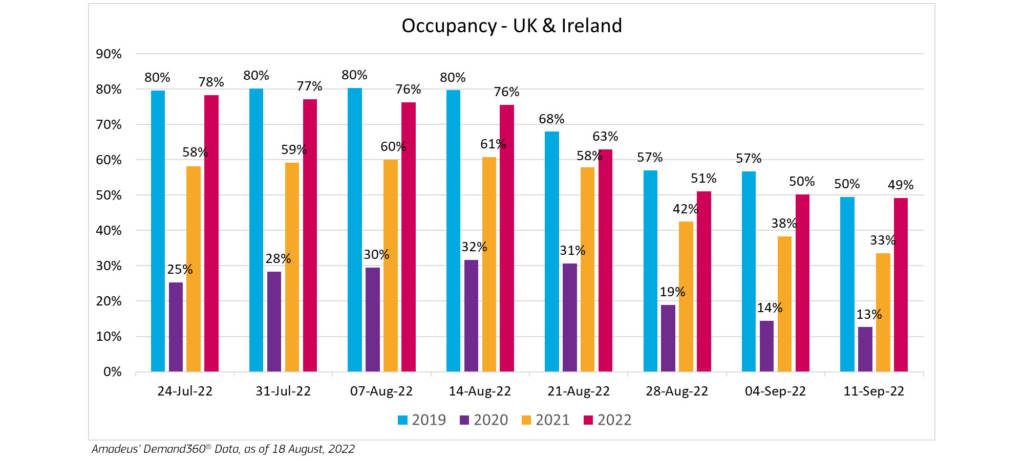

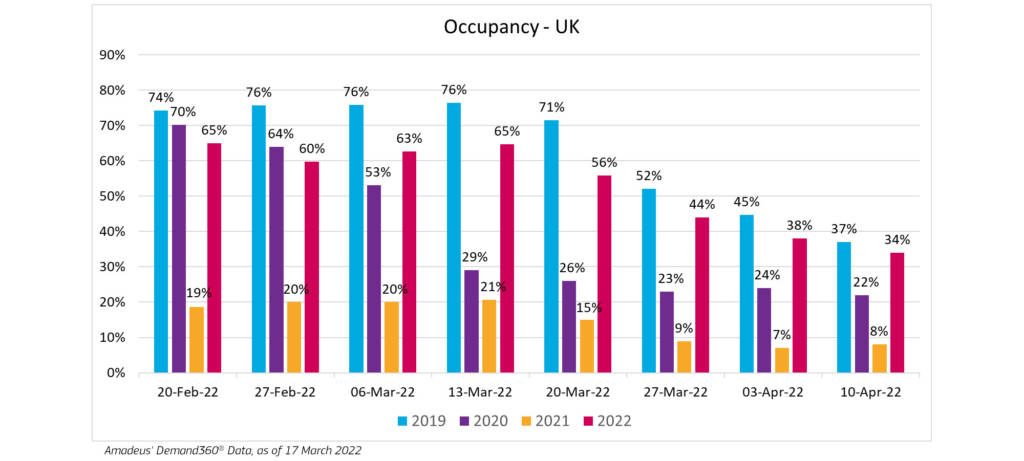

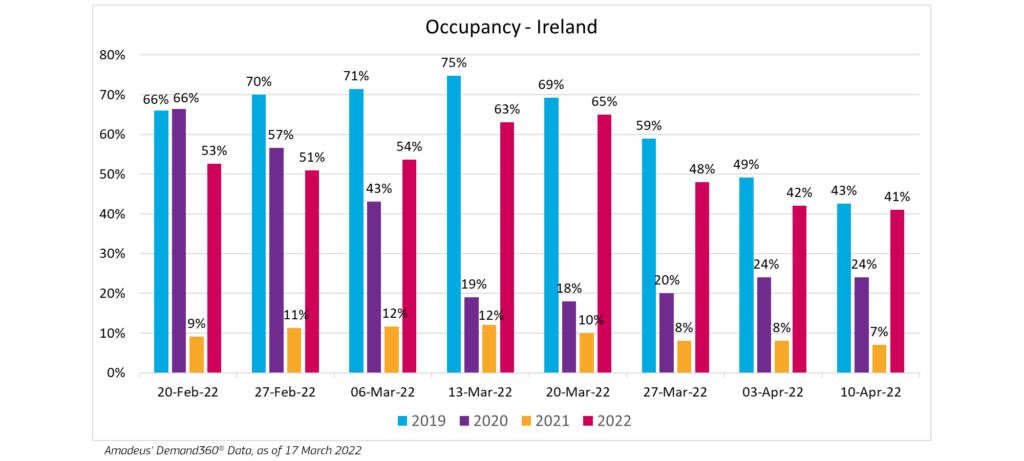

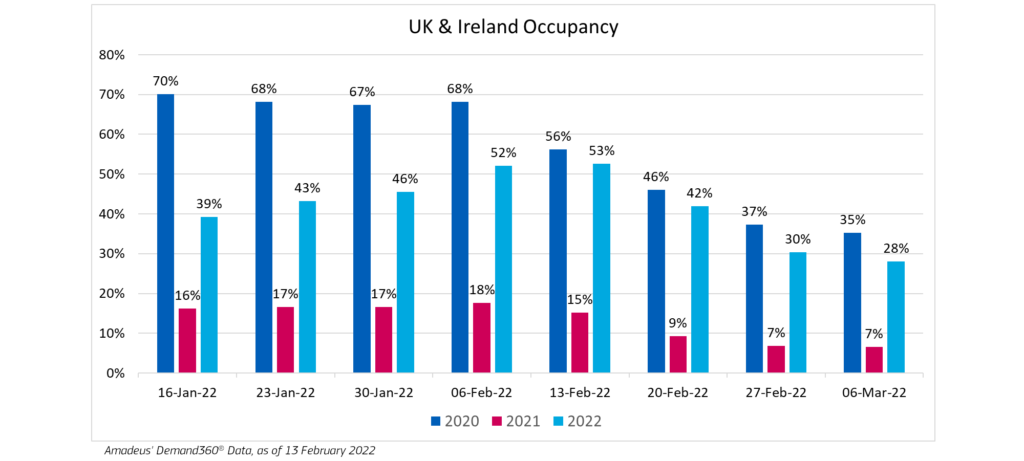

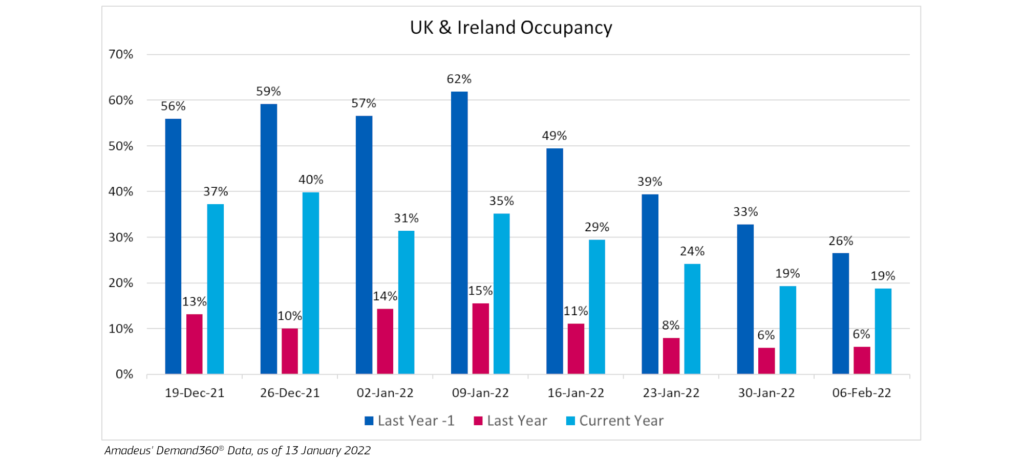

Some summer weeks are already showing occupancy above pre-pandemic levels

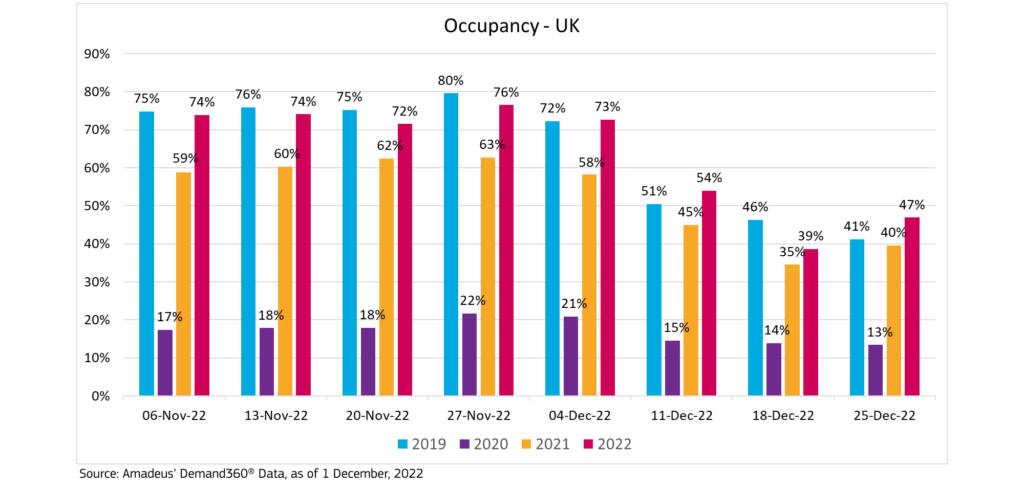

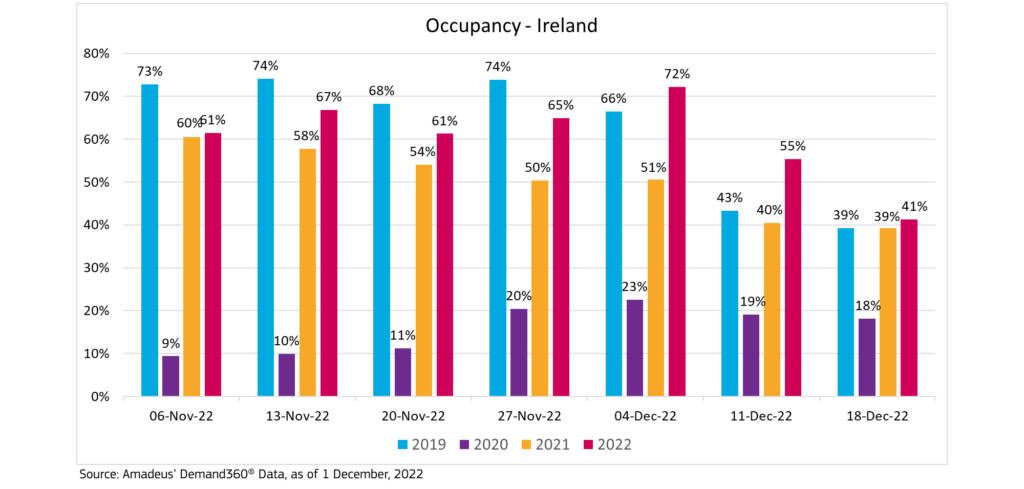

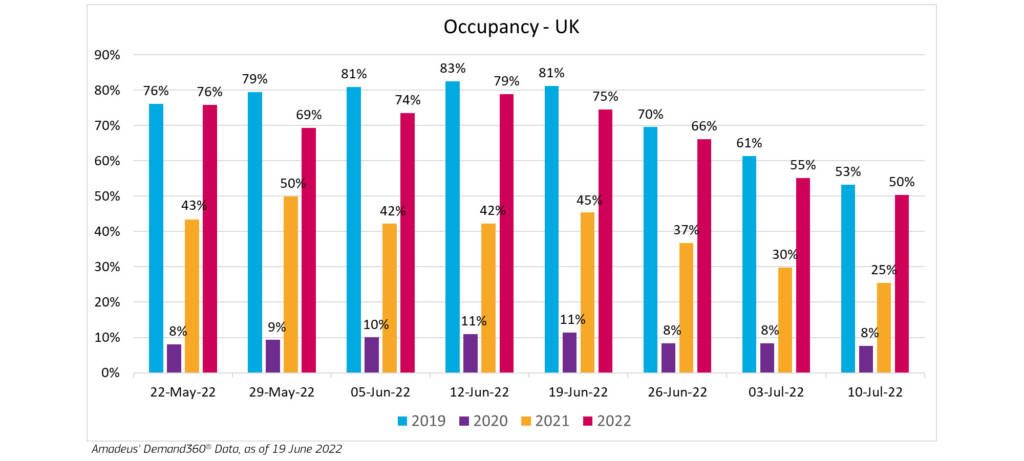

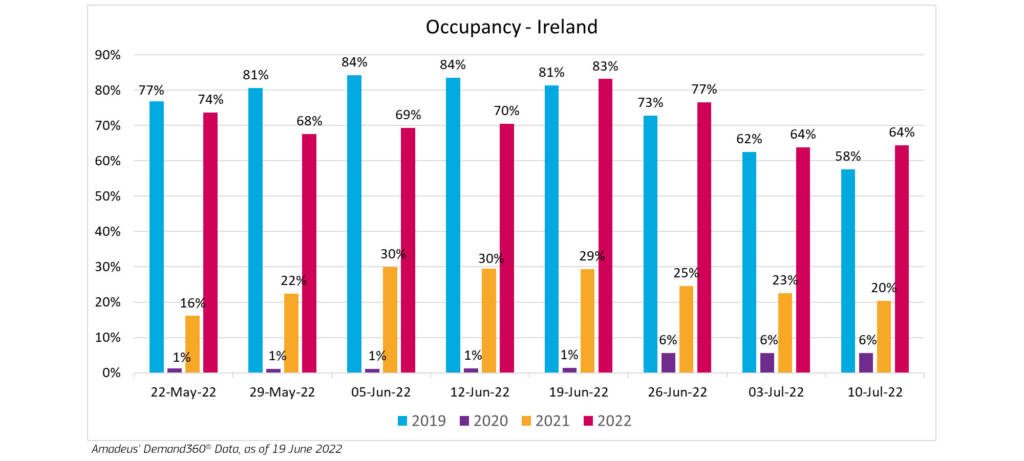

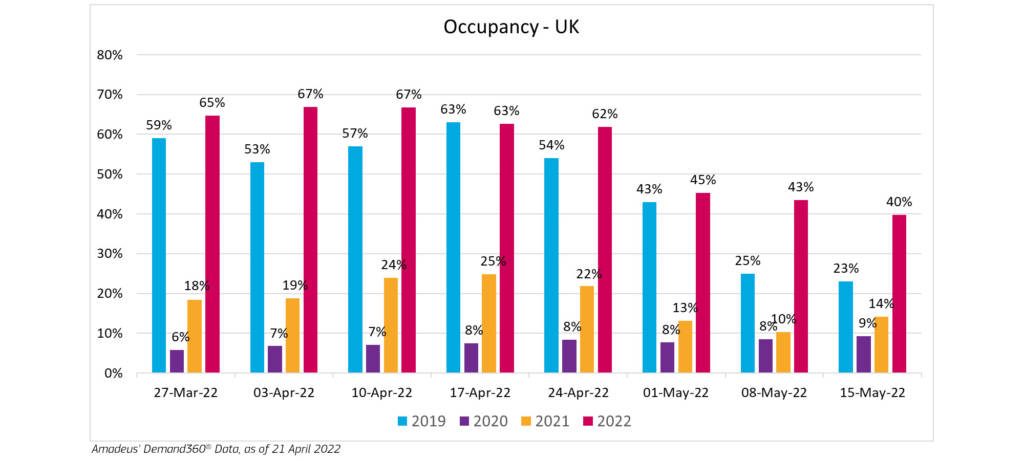

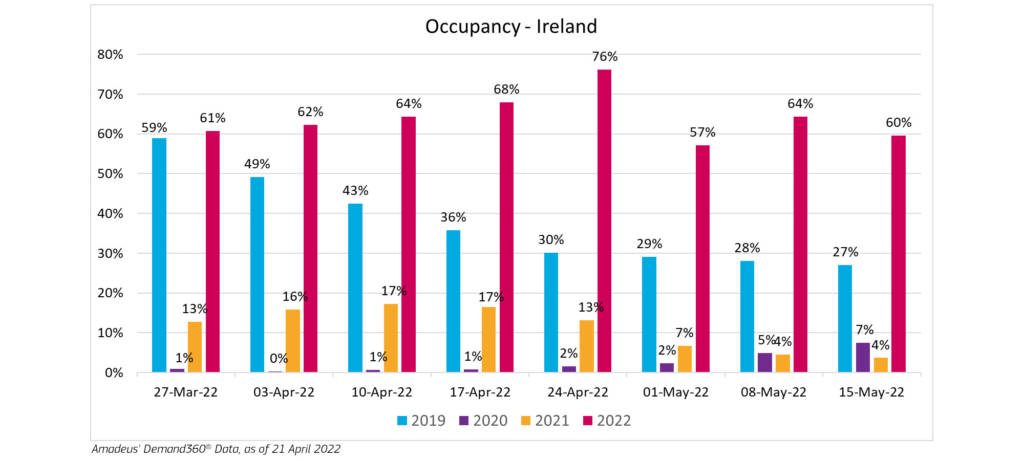

The start of summer in 2019 showed some strong occupancy rates, and while the UK is still a little behind this year, for some weeks in Ireland, occupancy rates are higher in June & July, 2022. Both the UK & Ireland show occupancy rates considerably higher than in 2021, when reopening was happening steadily, events began taking place, hospitality venues could seat people inside, and hotels were allowed to open their doors once again. Seeing this jump in occupancy compared with last summer is positive.

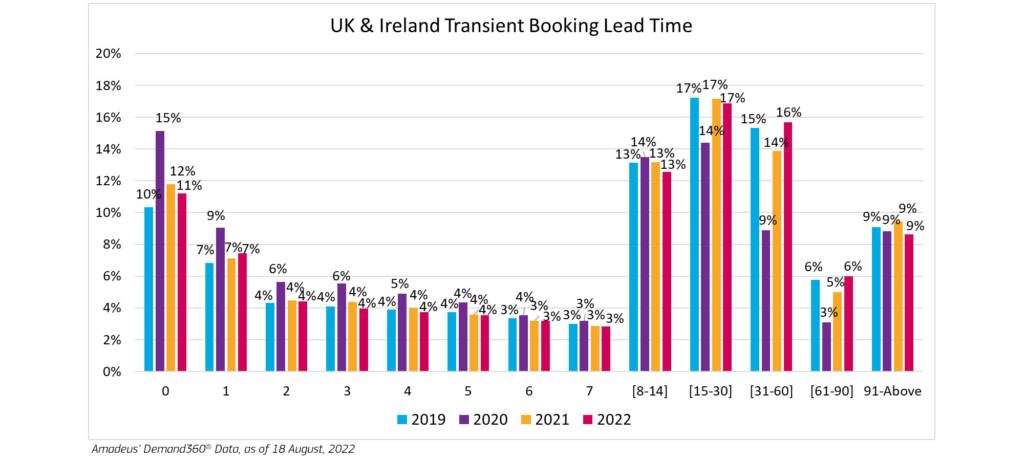

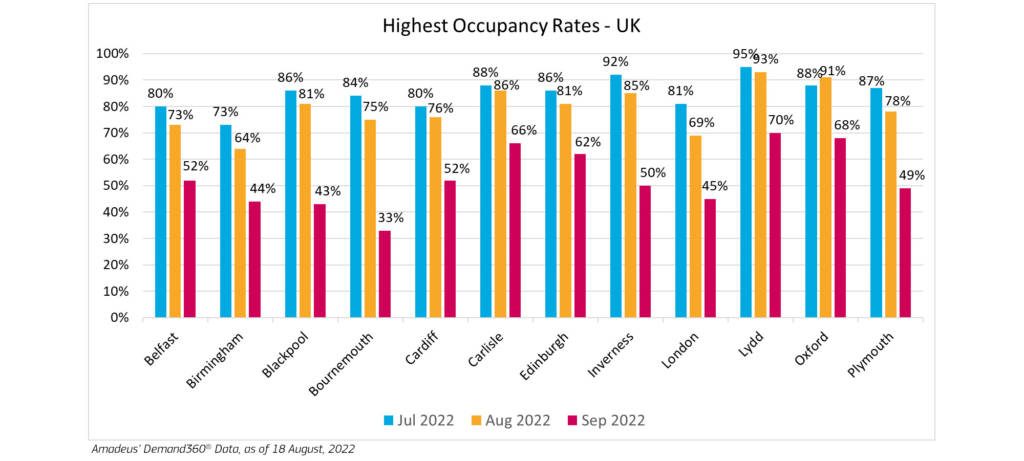

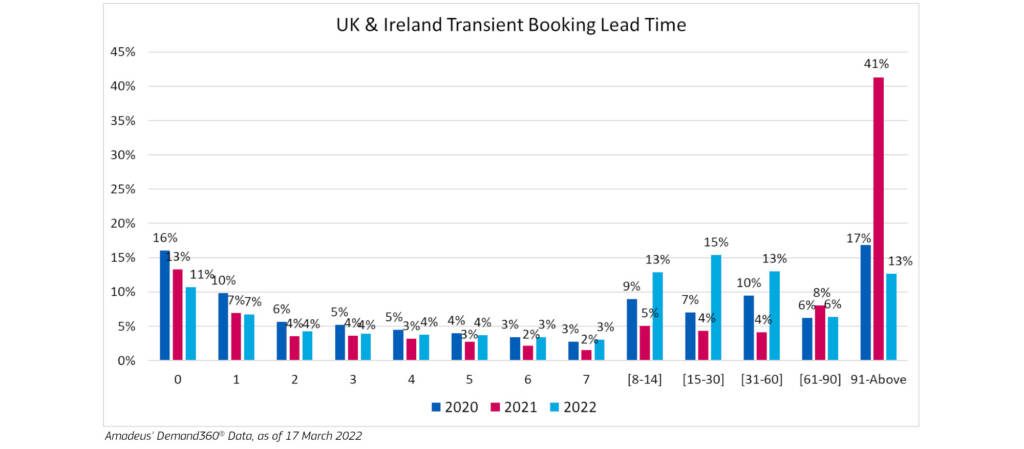

For the UK, May ended with an average occupancy of 73% and June is currently peaking the week of 12th June at 79%. With lead times remaining short, the weeks of 19th and 26th June will likely pick up. July is currently sitting just behind 2019 numbers, with an average of 53% occupancy for the first 2 weeks of July 2022, compared to an average of 57% for the same time in 2019.

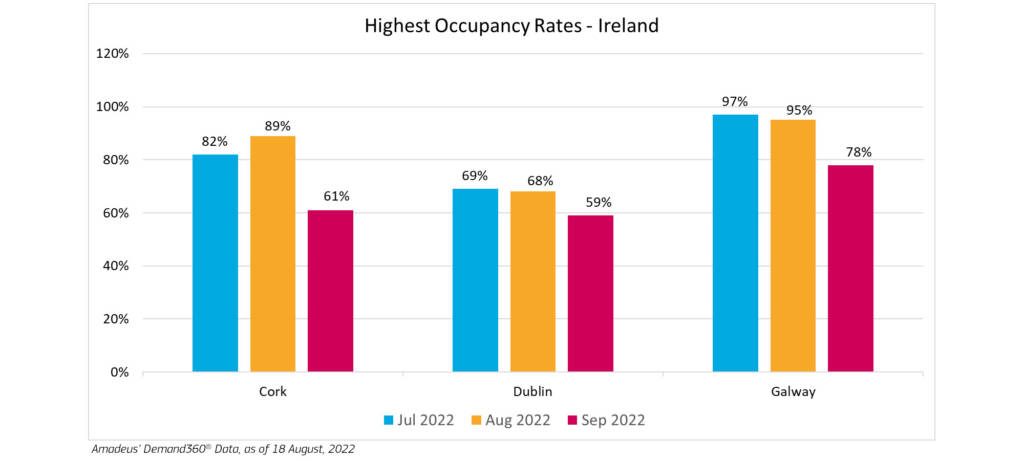

As for Ireland, May ended with an average of 71% occupancy and June is currently peaking, above 2019 numbers, the week of 19th June at 83%, a number which will likely increase when the full data for that week is reported. The last week in June and first two weeks of July are also showing higher numbers in 2022, compared with 2019, and will likely grow due to short lead times.